Can’t seem to get your books closed until waaaayyyy after the end of the month?

…Discover the “Accountants’ Secret” to closing your books…

Quickbooks Month-End Closing System

Use this Month-End Closing System to Achieve

Accurate, Reliable Reports from QuickBooks

(On Time!) Each and Every Month…

Are You Tired of Getting Late, Inaccurate, and Confusing Reports?

The secret is to have a documented system for closing your books every month.

A month-end closing system defines that structure so your reports are accurate, timely, and informative, so you can make better financial decisions.

Are you struggling with any of these accounting issues?

Do you receive accurate, meaningful financial and job cost reports from your QuickBooks accountant every month?

Do you receive accurate, meaningful financial and job cost reports from your QuickBooks accountant every month?- Do your reports make sense? Are they helpful?

- Are all your job costs properly assigned?

- Do your “Costs by Job” agree with your company totals?

- Are all of your bank and credit cards reconciled each month?

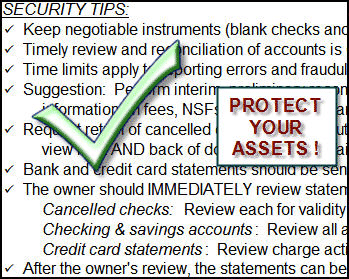

(Did you know that banks won’t cover fraudulent checks and card charges if you discover them after the bank’s cut-off date?) - Are your valuable accounting records backed up?

- Is your QuickBooks file formally closed (to protect against unwanted changes) each month?

- Are you aware of, and have you implemented, basic anti-fraud controls?

If you answered “No” to any of these questions, it’s not your fault. Unless you’ve been working with a professional accountant who helped you create a closing system for QuickBooks, you probably haven’t realized how a standardized, date-driven month-end closing process can become a powerful tool to help you extract the accurate, timely reports and results you need from your accounting system.

And there’s something I know about you. You’re likely reading this because you don’t have the skills, interest, and time to figure out how to create and implement your own month-end closing checklist.

There’s an easy solution. Use ours! We’re accounting experts who know exactly what it takes to simplify and speed up the process of closing your books each month and getting the reports you need!

$997

Dramatically Improve the Quality and Accuracy of Your QuickBooks Financial Reports

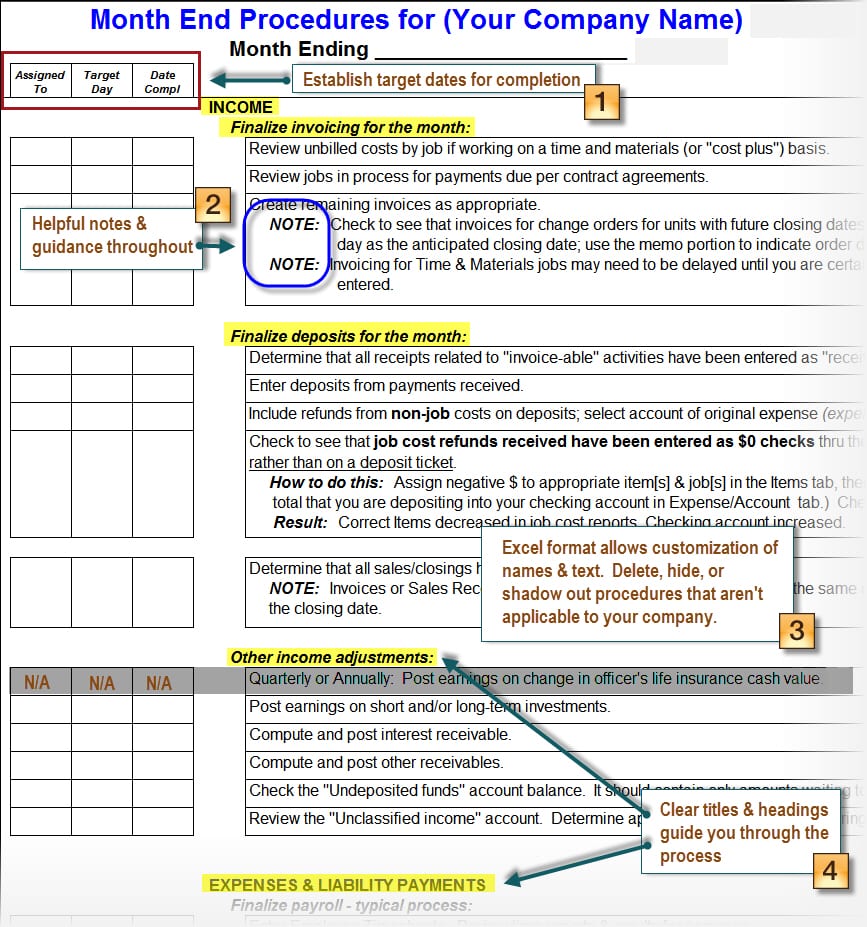

If you (or your staff) can read and utilize a checklist, you (or they) can easily perform the steps outlined in this month-end closing, proofing, and balancing system.

Simply set your target dates, and then perform the clearly defined action steps each day until the prior month’s accounting results are finalized (“closed”). You’ll see an immediate improvement in the reliability and usefulness of your critical data.

Does Our Month-End Close System Work? Absolutely!

“My books were a mess. I couldn’t get any valuable or correct information out of them, and I was trying to manage more ‘by the numbers’… I needed help.

“My books were a mess. I couldn’t get any valuable or correct information out of them, and I was trying to manage more ‘by the numbers’… I needed help.

The Month-End Closing System product has been important because it helped structure my books correctly and provided a way of managing them.

Info Plus Consulting’s Month-End Closing procedures have been critical because they let me know I’m in control of what’s happening in my books. I catch a lot of things as I go through them, so it gives me a level of comfort to know that I can find and fix any problems.”

Catherine Baldi, Principal & Company Manager, Arana Craftsman Painters

What You’ll Get In Our QuickBooks Month-End Closing System

This closing system is organized progressively. That means accounting actions and corrections taken during initial steps flow through to later steps. And that helps to minimize “circular” re-work or undiscovered errors.

This System Covers:

- Making sure that all Income has been recognized and entered.

- Checking to see that all costs and liability payments appear to be entered and accurate

- Checking for Budget changes

- In-depth checks of Balance Sheet and Profit & Loss account balances

- Preliminary review of key reports for reasonableness

- Final adjustments and allocations

- Preparation of standard monthly reports

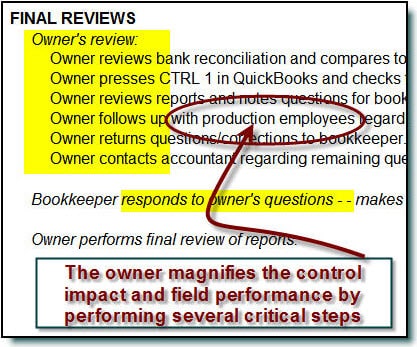

- Final (owner’s) reviews and resulting modifications, if needed

- Month-end wrap-up (backups, file integrity checks, filing reports, closing dates)

- Basic accounting controls designed to help prevent and/or detect internal fraud

You will also find it easy to establish and achieve internal target dates, assign accountability for specific procedure steps, and customize them to accommodate conditions unique to your company.

Review and customize the system, set the dates, and go!

Risk Free – Try it Now!

$997

Sample Screenshots

Month-end System – Example Showing Opening Lines and Features (See Numbers for Features)

Example from Owner’s Month-End System Review Steps (below)

Example From Security Hints, Tips, and Reminders Included in the Month-End System (below)

Do All Businesses Need a Month-End Closing System?

Unless you are a very, very small business, the answer is YES! Every single transaction entered into QuickBooks (or any accounting system) contains a number of fields that need to be completed. No matter how diligent or experienced the bookkeeper or accountant is, it’s nearly impossible to enter the thousands of details perfectly every month.

And, due to continuing time pressures, without a clearly defined process to double-check results, bookkeepers seldom re-visit their work.

The result? Records, files, and reports that can contain numerous errors – reports that leave business owners doubting the validity of what they see in their own company’s records!

Or even worse, the owner trusts the data, but it’s unknowingly wrong or (gasp) fraudulent!

This QuickBooks Month-End Closing System is an Accountant-Designed Solution…

In my 15 years as a Certified Public Accountant (CPA) and my current role as an Advanced QuickBooks ProAdvisor, I’ve watched business after business struggle with this problem! That’s why I created this Month-End Closing System system…

Use this system to save yourself the time and trouble of creating your own system and avoid getting the wrong, dated, or incorrect information (which could put yourself and your company at risk!)

Some clients have asked us to perform the steps in this quality-control system on their behalf. But, in most instances, the better long-term solution is to empower your company’s internal bookkeeping staff to learn how to systematically self-review, self-correct, and protect your monthly accounting records, job cost reports, and other valuable financial assets.

The result? You, as the owner, can finally count on seeing accurate, useful reports each and every month. That significantly reduces the need for you to rely on expensive, external professional accounting services!

…

Meet the Creator of Your QuickBooks Month-End Closing System

Meet the Creator of Your QuickBooks Month-End Closing System

Diane Gilson – QuickBooks Certified Advanced ProAdvisor

In addition to being an award-winning Accountant and QuickBooks Certified Advanced ProAdvisor, Diane Gilson has taught, coached, and advised thousands of QuickBooks users in the construction industry.

In this program, Diane combines her 30+ years of accounting experience (including 15 years as a CPA and 4 years as a Certified Internal Auditor) with her passion for job costing. Helping company owners, accountants, and bookkeepers drive more profits through job costing and better financial management has been the heart and soul of her business for more than 20 years.

“It just made sense to purchase the Month-End Closing System because it is another great tool created by Info Plus Consulting that is just unbelievably full of content.”

Sue Straatman, Innovation Mechanical

Get your accountant-prepared Quickbooks Month-End Closing System Now

And enjoy more accurate, timely, and reliable information to help improve your financial decisions!

$997

Note 1 – Procedure file customized with your company name and delivered via electronic transfer. License valid for one company and one computer.

Note 2 – Consultants & Accountants: We love working with consultants and accountants, but please note that this product is NOT licensed for use with multiple entities. If you wish to utilize this product for more than one client, please contact us for helpful insights and discounted licensing arrangements. We appreciate your consideration regarding legal intellectual property rights….