Are you missing out on what Percentage of Completion adjustments can reveal about your month-to-month profitability?

- Does your company take on long-term jobs? (Jobs are ‘long-term’ if income and/or costs stretch across more than 1 month)

- Do you find that your gross profits and job profitability reports ‘swing’ dramatically from month to month?

- Are you guessing at your current (and future) company and job profitability?

- Do you know that you SHOULD make Percentage of Completion adjustments but find it too difficult or confusing?

- Do you have to wait for and then pay your external accountant to make these critical entries?

If so, use the Percentage of Completion Analyzer to accurately compute the numbers and provide the exact journal entries you need to make these critical adjusting entries!

Percentage of Completion Analyzer™

(P-O-C Calculations & Journal Entries)

$997

More Than 130 Satisfied Customers!

This Percentage of Completion ‘Calculation & Entries’ tool helps you identify and extract the information you need for these crucial accounting entries.

This Percentage of Completion ‘Calculation & Entries’ tool helps you identify and extract the information you need for these crucial accounting entries.

It computes results based on your Estimates, Change Orders, and job cost accounting reports. If you are aware of ‘over-runs’ or ‘known under-budget’ savings, you just add them to the Analyzer.

That means you DON’T need to wait on or obtain ‘percentage guesstimates’ from job-site supervisors!

Just make your entries into the Analyzer for jobs in progress. It will then automatically and accurately compute your “over-billed” and “under-billed” amounts, job by job. It then presents results in a Journal Entry format – so you can quickly and easily make the entries into your accounting system…

It saves hours of work, frustration, and worry.

The result:

Your job cost reports instantly show your true monthly and life-to-date gross profit for each of your long-term, ‘open’ jobs. This means you will also be able to see a more accurate picture of overall company profitability.

How to Calculate Percentage of Completion (POC) Accounting Entries On Your Own

Using the percentage of completion method in your accounting is simple to summarize. Unfortunately, applying it to calculate the appropriate journal entries by hand is time-consuming and complex.

The Percentage of Completion Formula Journal Entries

If you want to make POC calculations and entries on your own, you need to use the steps of the Percentage of Completion Formula:

- Calculate the percentage of incurred costs versus the total costs budgeted for the project.

- Apply that percentage amount to the total amount you will receive for the project (including change orders and adjustments).

- Calculate the difference between the amount invoiced to date and the amount calculated in step 2.

- Determine debits and credits and make the journal entry on the last day of each month to adjust income up or down by the amount calculated in step 3.

- Create another accounting journal entry on the first day of the next month to reverse the accounting entry made the day before.

- Do all the above for each project your company is working on.

Sounds complex, right?

There IS a solution…

That’s why we created the Percentage of Completion Calculator.

Use it to calculate and make the appropriate accounting journal entries in minutes. Compare that to the dozens of hours it will cost you if you’re applying it to multiple jobs across your company!

Picture this – it’s late at night after a tough day. You and your accountant are sitting in a room trying to remember how to do all of the procedures shown above. (For example, gathering the numbers, punching them into your spreadsheet, looking at the results, possibly uttering a few words your grandmother may disapprove of, double-checking to make sure you got it all right, finding your errors, starting over, uttering those words again, then making the journal entries and double-checking to make sure everything got booked appropriately.)

Picture this – it’s late at night after a tough day. You and your accountant are sitting in a room trying to remember how to do all of the procedures shown above. (For example, gathering the numbers, punching them into your spreadsheet, looking at the results, possibly uttering a few words your grandmother may disapprove of, double-checking to make sure you got it all right, finding your errors, starting over, uttering those words again, then making the journal entries and double-checking to make sure everything got booked appropriately.)

Sound familiar?

Now, add up your personal fully-burdened labor burden rate plus your accountant’s hourly rate and multiply the result by the number of hours you spend each month.

Now, multiply that number by 12 to get a full year’s cost of trying to do it by hand! (And don’t even consider the frustration and increased likelihood of a migraine or risk of a heart attack…)

Can you see why I say that at less than $1,000, our Percentage of Completion Analyzer is a steal at this price!?!

Stop the confusion and frustration over your Percentage of Completion adjustments! You can now consistently make these entries on your own without the time and frustration of doing it yourself. (Or incurring the cost of paying for [or waiting on] an outside accountant.)

Your Percentage of Completion Analyzer includes a User’s Guide, an overview of Percentage of Completion concepts, and sample calculations and entries.

Your Percentage of Completion Analyzer includes a User’s Guide, an overview of Percentage of Completion concepts, and sample calculations and entries.

Meet the Creator of the “Percentage of Completion Analyzer™“

Diane Gilson – QuickBooks Certified ProAdvisor

In addition to being an award-winning Accountant and QuickBooks Certified ProAdvisor, Diane Gilson has taught, coached, and advised thousands of QuickBooks users in the construction industry.

In this program, Diane combines her 30+ years of accounting experience (including 15 years as a CPA) with her passion for job costing. Helping company owners, accountants, and bookkeepers drive more profits through job costing and better financial management has been the heart and soul of her business for more than 20 years.

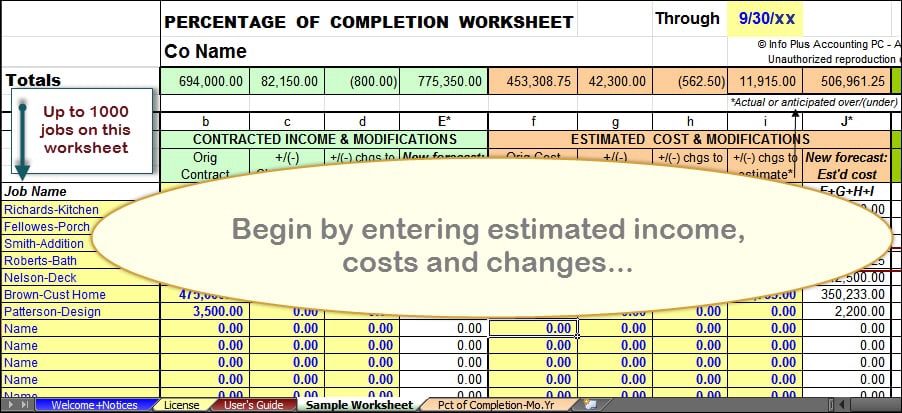

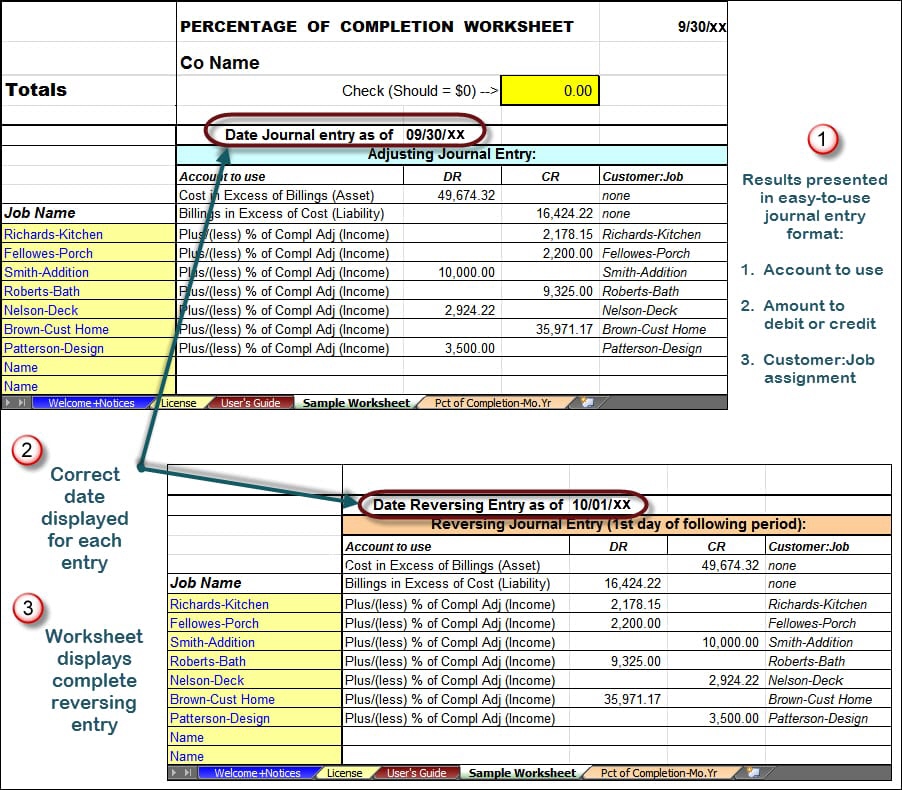

Screenshots from the Sample Worksheet: Percentage of Completion Analyzer™

(screenshots below move from left to right side of sheet)

$997

Overview of the Percentage of Completion Analyzer™

Easy entry:

- Simply enter information in pale yellow cells

- Color coding and color groupings make it easy to see exactly which section of the sheet you are using or viewing

- Print entire reports or segments as desired

- Save each month’s file as a permanent record to support and document your entries

- Up to 1000 jobs in a single sheet

- And more…

Original Estimates, Change Orders, Known Overages, and Other Revisions to Estimates:…

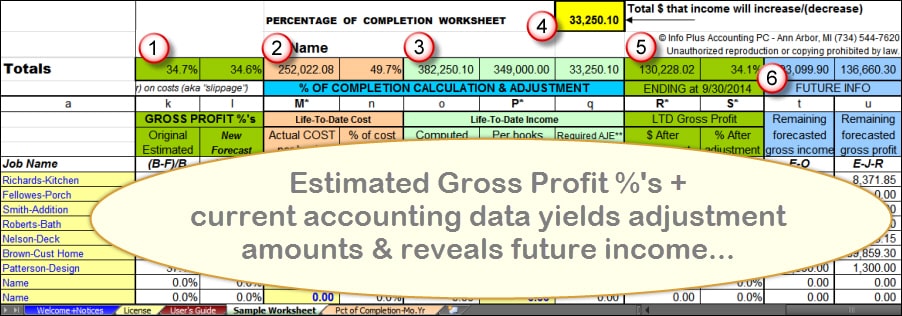

Percentage of Completion Calculations and Forecast:…

All amounts and percentages are displayed by Job and in total:

- These columns show the computed original estimated gross profit as well as revised estimated gross profit

- When you enter actual life-to-date job costs, the % of life-to-date job costs automatically compute

- When you enter actual life-to-date job income, your resulting adjustment automatically computes and displays

- This field reveals the total amount that company income will increase or decrease as a result of your Percentage of Completion adjustments

- These columns show the amount and % of each job’s life-to-date gross profit after your adjustment. (Note: This is a great way to double-check results after you make your entries).

- This column is where you see the remaining forecast for gross income and gross profit

The Resulting Journal Entry Output is Easy to Use:

…

$997

Note 1 – License valid for one company and one computer.

Note 2 – Consultants & Accountants: We love working with consultants and accountants, but please note that this product is NOT licensed for use for multiple entities. To utilize this product for more than one client, please contact us for helpful insights and discounted licensing arrangements. We appreciate your consideration regarding legal intellectual property rights…