Calculating overhead can be tricky, but QuickBooks can help you calculate and monitor your business overhead expenses more efficiently and effectively.

Business Overhead Expenses: What They Are and How To Calculate Them

Have you ever wondered exactly WHAT business overhead expenses really ARE?

Do you know what YOUR business overhead expenses are? Or how to go about actually calculating your business overhead expenses?

Maybe someone else has done your accounting in the past, so you haven’t been in touch with how your overhead expenses were calculated. And now you realize that it’s time to get a handle on these critical numbers!

Why Business Overhead Expenses Are Critical

You may be wondering why these numbers are “critical”? Why would you even care to know about them?

Primarily because if you know how to properly calculate business overhead, you can monitor and reduce your business overhead expenses and increase your profit.

Business Overhead Calculator: QuickBooks

But rather than digging out the calculator or entering numbers into a spreadsheet to figure things out, here’s a better idea: Use your QuickBooks accounting software to do a lot of the work for you, so you can see not only the results (in dollars and percentages), but exactly how those numbers have been built.

The best way to manage your business overhead expenses is to spend your time monitoring and managing your results rather than crunching numbers! Start the process by getting your QuickBooks software to actually calculate your overhead for you. Then you can spend your time in the most productive possible way: by working ON your business.

How To Calculate Overhead Expenses – What Costs Are Included?

First of all, for those who may just be starting to learn how to manage their own in-house accounting system…

Business Overhead Expenses Definition

Basically, business overhead expenses are the costs necessary to continue operating your business but that are not related to creating your primary source of income.

In other words, these are the costs that you have to pay in order to keep your doors open.

Business Overhead Expenses include costs such as:

- Marketing costs

- Administrative compensation and benefits

- Rent & Utilities

- Professional fees

- Other general company costs such as licenses, dues and subscriptions, administrative vehicles, professional development, etc.

Using QuickBooks to Calculate Business Overhead Expenses…

If you want QuickBooks (or QuickBooks Enterprise) to automatically calculate your actual business overhead expenses (as well as the percentage of income you are spending on business overhead expenses), follow these steps. Start with your Chart of Accounts:

-

Review and determine which of your expense accounts are costs related to earning income.

They could be “direct” costs (easily assignable to a job) or “indirect costs” (costs related to earning your income but not as easily assignable to a job).

…

For example, a direct cost would be materials you can assign to a job, while an indirect cost could be small tools or fuel costs that can’t be tracked to specific jobs.

…

Confirm that those costs are sitting in the ‘Cost of Goods Sold’ (COGS) account type. If you see that they’re appearing in an “Expense” account type, you should move them into the COGS account type.

-

Review the costs now sitting in your COGS account type. Determine if any of those accounts represent business overhead expenses (as discussed above).

Be sure to move those accounts into ‘Expense’ account types.

You’ll likely want to review the results and sort accounts within the account types, but that’s basically how to go about the process.

Now, when you run your Profit & Loss reports in QuickBooks or Enterprise, you will be able to see the total amount of your overhead expenses. You will see them totaled and displayed near the bottom of your report as ‘Total Expense.’

Compare Your Business Overhead Expenses to Your Income

In order to compare overhead and profit for your business, the next step is to see how QuickBooks calculates the percentage of your overhead expense in comparison to your income. To do this:

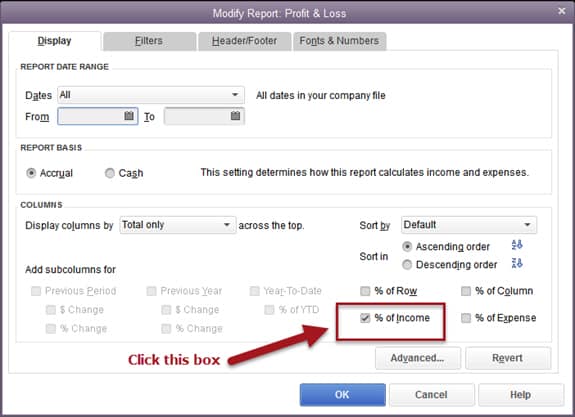

- From your Profit & Loss screen, click on the Modify Report window and select the ‘% of Income’ box. Then click OK.

- On the screen that displays your Profit & Loss report, you’ll see that QuickBooks has divided your indirect costs (overhead) by your total income.

- The resulting percentage will reveal your overhead rate in relation to income. From here, you can compare your overhead rate to others in your industry to see how you compare.

Now, you’ll be able to see how much of your income (dollars and percentage) is dedicated to paying overhead. Remember, these are the expenses that are going toward simply keeping your doors open and may or may not be worth the amount you are paying for them because these expenses are not directly making you a profit.

How to Decrease Business Overhead Expenses and Increase Profits

If you want to increase your profits, one way is to reduce your overhead expenses. Now that you can easily see what you’re spending on business overhead expenses, you’ll be able to look at your monthly, quarterly, and yearly results, review details, and see if you can eliminate or negotiate better rates for some of those overhead expenses, such as phone services, subscriptions, marketing or rent. Maybe you can wipe out a particular cost altogether!

This shouldn’t be a one-time process! Now that you understand the process of using QuickBooks for automatically calculating overhead, you should be able to use this information to enhance your overhead and profit results on an ongoing (monthly or at least quarterly) basis.

![]()

People Also Ask

FAQs (Frequently Asked Questions)

1. What are business overhead expenses?

Business overhead expenses refer to the ongoing costs necessary for operating the non-production portions of a business, such as rent, utilities, insurance, salaries, and office supplies.

2. How do you calculate business overhead expenses?

To manually calculate business overhead expenses, look through your account balances and add up all fixed and variable (non-production) costs required to run the business on an annual basis. If you’d prefer to have QuickBooks add those numbers for you – and display the results in your reports – be sure to assign your business overhead accounts to the “Expense” Account Type.

3. Why is it important for businesses to manage overhead expenses?

Managing these expenses is crucial as it directly reduces profitability by reducing gross profits. When you have reasonable gross profits, controlling these costs also contributes to financial stability.

4. What are examples of fixed overhead expenses?

Examples of fixed overhead expenses include rent, property taxes, insurance premiums, telephone, internet services, ongoing professional fees, and salaries and benefits for permanent staff. “Fixed costs” do not (generally) vary in relationship to changes in revenue.

5. What are examples of variable overhead expenses?

Variable overhead expenses fluctuate based on business decisions and can include vehicle repairs & maintenance, fuel, business travel, consulting fees, advertising campaigns, shop supplies, and commissions.

6. How can businesses reduce overhead expenses?

Businesses can renegotiate contracts with suppliers, adopt energy-efficient practices, outsource non-core functions, and implement technology solutions to streamline operations.

7. What role does budgeting play in managing overhead expenses?

Budgeting helps businesses plan and allocate resources effectively (including overhead), ensuring financial goals are met and resources are used efficiently.

8. How does QuickBooks help track and manage business overhead expenses?

QuickBooks allows businesses to group and categorize expenses, generate financial reports, track and compare costs and spending patterns, and analyze and review overhead costs. Each of these activities provides insights to assist with financial management.

9. What challenges do businesses face when managing overhead?

Challenges include accurately forecasting overhead costs, balancing cost-reduction efforts without compromising quality, and adapting to economic fluctuations.

10. Where can I find more resources and guides on managing business overhead expenses?

Additional resources and guides are available on the Build Your Numbers website.

![]()

Let Us Help You

This is an example of why we’re here: to help business owners take control of their accounting systems using QuickBooks and Enterprise – and to show them how they can use their numbers in ways that help them see more success from their business and boost their profits!

If this information helped you, check out our affordable QuickBooks subscription training series. If you’d like individual coaching or have any questions, please give us a call or send us an e-mail today.

Customer Praise For Diane Gilson, Info Plus Consulting, and BuildYourNumbers.com

⭐⭐⭐⭐⭐ From the Intuit FindAProAdvisor website:

“We initially engaged with Info Plus when we transitioned from Buildsoft Accounting & Job Costing to QuickBooks. We became a consulting client in 2019 to set up QuickBooks for better job costing. Their CAMP program made it easy to continue our education/knowledge of job costing with QuickBooks (we were a subscriber for 13 months). A year later, I was in a panic to open a year-end report and needed to retrieve a password somehow. I emailed Diane for help with this. She and her team responded quickly and were knowledgeable on how to do this!”

See More Customer and Client Comments