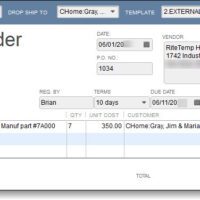

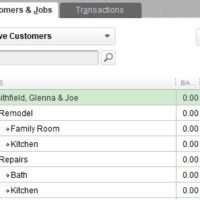

How Percentage of Completion Entries Fix Revenue Fluctuations for ‘In-Process’ Contracts The Problem with ‘In-Process Contracts’ Custom builders and project-based firms often invoice per contract stages over extended periods, from several months to over a year. As a result, income is nearly always booked either: Before costs are entered into your accounting system and/or After …