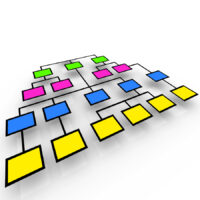

Hierarchical View in QuickBooks Do you have QuickBooks lists structured to show in a Hierarchical View? (Think “outline” with headers and sub-elements.) For instance: In your Customer:Job list, do you have a “header” as a Customer and sub-elements as Jobs? (If not, you may want to do so…) Open your Item List. Do you have …