In this article, I’ll explain gross profit percentage and markup, AND I’ll give you 2 free “Quick Conversion Charts” to print and carry with you to quickly calculate markup and gross profit percentage.

To succeed in business, it’s important to understand two key concepts: gross profit (margin) and markup.

Let’s start with some definitions.

What is Gross Profit?

Gross profit is a measure of profitability. It shows gross revenue minus the direct costs of producing or delivering a product or service.

Gross profit provides insight into the profitability of a company’s core business activities. (I.e., it excludes indirect costs such as marketing, administrative expenses, and taxes.)

It is a key indicator of how efficiently a company produces and sells its products and services.

How Do You Calculate Gross Profit?

Gross profit is calculated by subtracting the cost of goods sold (COGS) or cost of production from the total revenue generated from sales for a project, division, or total company.

The formula for calculating gross profit is:

Total Revenue – Cost of Goods Sold (COGS) = Gross Profit

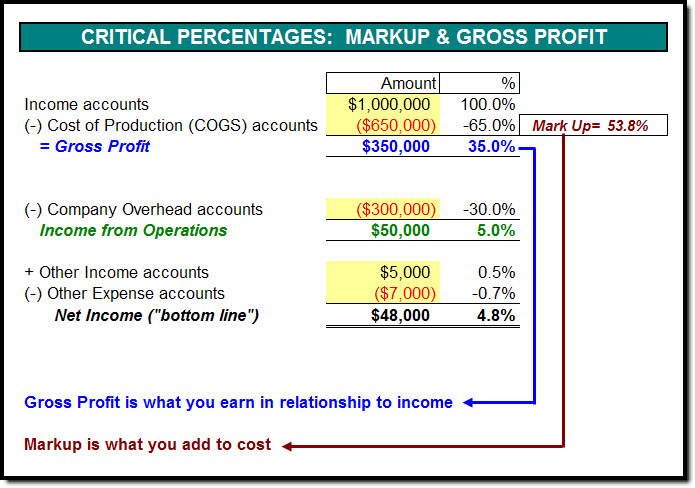

Example: If your total revenue on a project was $1,000,000 and your cost of goods sold was $650,000, your gross profit on that project would be $350,000

Total Revenue: $1,000,000 – Cost of Goods Sold: $650,000 = Gross Profit: $350,000

Gross Profit Percentage (Margin)

In plain English, this is the percentage of money you’ve made from selling goods or services – after subtracting the cost of producing those goods or services.

Gross profit percentage is calculated by dividing your gross profit by the total revenue for the company, then multiplying the result by 100 to show it as a percentage.

(Gross Profit / Total Revenue) * 100 = Gross Profit Percentage

To use the previous example:

(Gross Profit: $350,000 / Total Revenue: $1,000,000) * 100 = Gross Profit Percentage: 35%

You want that percentage to be as high as it can reasonably be. The higher your gross profit percentage, the healthier your business and the more profit you’ll take home at the end of the day.

Now, let’s look at markup.

What is Markup?

Markup is a pricing strategy used to determine how much you should charge for a product or service based on its cost.

It is usually expressed as a percentage (or a fixed amount) added to the cost to arrive at the selling price.

If you want to know the markup percentage on a particular job, divide the gross profit by the cost of goods sold (COGS) for that job, then multiply the result by 100 to see it as a percentage.

(Gross Profit / Cost of Goods Sold) * 100 = Markup Percentage

To calculate the markup percentage for our example:

(Gross Profit: $350,000 / Cost of Goods Sold: $650,000) * 100 = Markup Percentage: 53.8%

In other words, every dollar of cost was marked up by 53.8% to generate a gross profit of $350,000 on the project.

OK, that’s a lot of math. What if we simplify this by reviewing…

How To Use Markup In Your Business

Most companies choose a markup percentage they want to charge on every project. They need enough Gross Profit to pay for their overhead and still make a healthy profit. (Remember that the cost of goods sold doesn’t account for overhead.)

Choosing and applying a markup percentage is one quick and easy way to help determine how much you should charge for a project based on knowing your costs for that project.

In our example, the company might have determined they want to apply a 53.8% markup (we recommend choosing a rounded percentage 🙂) on every dollar they spend in costs, yielding the $350,000 gross profit on the $650,000 they spent for project costs.

Gross Profit Percentage and Markup Percentage Illustrated

Use this reporting example to see your Gross Profit. If you divide your Gross Profit by the Cost of Production, you will see your average Markup %.

- Does your Gross Profit provide enough dollars to cover your company’s overhead costs and still provide the net profit you need?

- Have you been charging enough?

Don’t want to bother calculating YOUR numbers by hand? Use this handy calculator!

Drop in your numbers for a project (or for your company) and see the results…

CLICK HERE to see HOW TO USE your Gross Profit & Markup Calculator

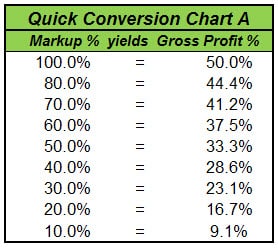

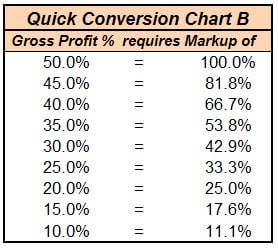

Using a Markup Calculator Conversion Chart

Use the following reference charts to easily convert between Gross Profit and Markup. Be sure to use a Markup calculator as you estimate costs and pricing for individual jobs.

Gross Profit Based on Markup Calculator

When you mark your costs up by the % in the first column, this shows your Gross Profit %.

Markup Calculator – Required Markup To Achieve Gross Profit Goals

To achieve the Gross Profit % shown in the first column, mark your costs up by the % shown in the second column.

![]()

People Also Ask

FAQs (Frequently Asked Questions)

1. What is a markup calculator, and how does it work?

A markup calculator helps determine pricing for an individual job by adding a percentage to the cost. You input the cost and desired markup percentage, and it calculates the price.

2. Why is gross profit margin important for businesses?

Gross profit margin indicates how efficiently a company produces its goods or services. It is crucial for assessing profitability and making pricing decisions.

3. How do you calculate gross profit margin?

Gross profit margin is calculated using the formula: [(Revenue – Cost of Goods Sold) / Revenue] x 100%. It shows the percentage of revenue that exceeds the cost of goods sold.

4. What is the difference between gross profit and net profit?

Gross profit is revenue minus the cost of goods sold. Net profit subtracts further expenses such as operating expenses, interest, and taxes from gross profit, reflecting overall profitability.

5. Can a markup calculator be used for services as well as products?

Yes, a markup calculator can be used for both services and products to determine pricing by adding a markup percentage to the cost.

6. How can I determine the appropriate markup percentage for my business?

Determine the appropriate markup by analyzing industry standards, market demand, competition, and your business costs.

7. What are some common pitfalls to avoid when using a markup calculator?

Avoid not considering all costs, relying solely on competitors’ prices for your markup, and not adjusting markup rates to reflect changes in costs.

8. Is there a difference between markup and margin?

Yes, markup is added to cost to determine the selling price, whereas margin is the percentage of revenue that is profit.

9. How frequently should I review my markup rates?

Review markup rates regularly, especially when there are changes in costs or market conditions. Quarterly or annual reviews are advisable.

10. Where can I find more detailed information about using markup calculators and optimizing gross profit?

Find more detailed information and guides on using markup calculators and optimizing gross profit on the Build Your Numbers website.

![]()

If you enjoyed this article, you’ll also love “5 Ways to Use Job Costing To Increase Your Gross Profits.”

Tip from Diane: Many of my clients like to print these Markup calculator charts in color. Some like to place them in sheet protectors or even laminate them!

Want more tips? Check out our Facebook page!

Customer Praise For Diane Gilson, Info Plus Consulting, and BuildYourNumbers.com

⭐⭐⭐⭐⭐ From the Intuit FindAProAdvisor website:

“We are a small CPA firm that uses Diane as our QuickBooks expert. She has worked with us and our clients in answering questions and solving problems that we couldn’t handle ourselves. We have a number of job cost clients and use her suggestions and direct help in setting up and working with their accounting systems. She knows the right way to handle job costing in QB. Diane is great to work with and responds quickly to our needs.”

See More Customer and Client Comments