This post about QuickBooks’ Items is excerpted from our more extensive training video that’s included in our Construction Accounting & Management Program (CAMP).

QuickBooks Items: Automating Job Costing for Construction Companies

QuickBooks Items enable construction companies to automatically track and report on the financial detail underlying what’s REALLY going on within the financial side of ANY of your jobs!

QuickBooks Items enable construction companies to automatically track and report on the financial detail underlying what’s REALLY going on within the financial side of ANY of your jobs!

If you can track and measure what’s happening, you can far more easily control the profitability of each and every one of your projects.

What is an Item In QuickBooks?

In QuickBooks, an Item is a product or service a company buys and sells. Using Items, a construction company can easily track detailed costs, purchase orders, variance reports, etc., for every job, which is key to effectively managing construction company finances.

Why Construction Companies Should Use QuickBooks Items

When construction companies and contractors establish and use a well-designed Item List in the proper way, you can…

- Track the actual detailed costs and income for each job.

- Create estimated costs and estimated income targets for individual jobs.

- Track “Open Purchase Orders by Job” (often referred to as “Cost to Complete”).

- Compare Estimated vs. Actual Costs for different job stages and Estimated vs. Actual Income for either Fixed-Price or “Open Book” jobs.

- Use these “Variance Reports” to:

- Track and control costs while a job is in progress (before costs spin out of control).

- Ensure that you are invoicing (and getting paid) for all contracted aspects of the job (including Change Orders).

- Review “after-the-fact” results with your team. By doing this, you can continuously improve estimating, operations, and profitability.

Certain transactions in QuickBooks REQUIRE the use of Items.

Certain transactions in QuickBooks REQUIRE the use of Items.

For example:

- Invoices and Sales Receipts (how you enter income earned for jobs).

- Estimates: This is where you enter estimated costs and/or estimated income for jobs.

- Purchase Orders: A feature that lets you enter exactly what you intend to purchase from contractors and vendors. (Purchase Orders add speed, accuracy, and cost controls to your accounting system.)

Other transactions allow you to use Items rather than accounts. For instance, you can use Items instead of accounts when you enter:

- Bills or Bill Credits

- Credit Card Charges or Credits

- Checks

Job Costing For Construction Companies

DIANE’S CRITICAL INSIGHT: Many QuickBooks users don’t realize the right ways to use Items.

Here’s the big secret: If you DON’T use Items to enter your job-related costs, you’ll miss out on nearly the entire value of the job costing process!

Exactly What Are QuickBooks Items?

Items are special “building blocks” integrated into QuickBooks desktop software. They are designed to let you track and monitor critical details about what is going on in your jobs.

Items are special “building blocks” integrated into QuickBooks desktop software. They are designed to let you track and monitor critical details about what is going on in your jobs.

QuickBooks Items deliver a “high def” picture vs. the “standard res” output that you receive when you use only accounts.

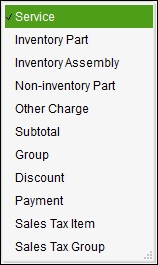

- There are 11 different types of Items in QuickBooks (see the illustration).

Each Item Type has certain qualities and performs certain tasks.

It’s imperative to understand exactly what each type of Item “does” and whether it’s appropriate to use in your specific circumstance.

Attention: Spec Home Construction Companies

Even though spec home builders refer to homes “in process” or completed as “inventory”, you should NOT use Inventory Items for those homes!

What Construction Firms Can Do With QuickBooks Items

Here are just some of the ways you can use (and benefit from) an intelligently designed Items List:

- You can create and customize Items to reflect YOUR specific construction process.

- Each Item also links to your Chart of Accounts. This means that with no double-data entry (!), you can see details about individual job stages such as site preparation, foundation, framing, windows, etc.

- You will also be able to see standard accounting reports with job costs summarized in major categories. Those categories include Income, Employee costs, Contracted costs, Materials Costs, and Equipment Costs.

- Reports will display:

- Gross profit dollars and percentages by job

- Gross profit dollars and percentages for your company in total

Get a PDF version of this article by clicking the following (no opt-in required):

QuickBooks Items: The Secret to QuickBooks Job Costing.pdf

Creating QuickBooks Items for Your Construction Business

DIANE’S CRITICAL INSIGHT: If you decide to create your Item List on your own, try building it in a spreadsheet first. Once you get your structure laid out in a spreadsheet, start creating individual Items inside QuickBooks.

Why? This can be a time-consuming and somewhat tedious process. You’ll likely change your mind several times as you figure out what you want to track. It will be far easier to do your “brainstorming” and modifications in a spreadsheet.

1. Establish the QuickBooks Item TYPES you will use.

- Learn about the various Item Types (illustrated in the previous screenshot) and understand how they link into accounts when you use them in transactions.

- Visualize how results will appear on reports.

- Finalize which type(s) of Items you want to use.

DIANE’S CRITICAL INSIGHT: We normally use Service Items converted into “double-sided Items” for job phases for construction companies. (The term “double-sided Item” is explained in step 5 of this article.)

2. Determine the “primary” job phases you want to track.

For example, we’ve defined 45 PRIMARY (big picture) CONSTRUCTION PHASES in our AccountingPRO™ Construction Template for QuickBooks. (And that doesn’t even count the phases we included for spec home specifics or land development projects!)

To fire up your thought process, here are the first seven primary phases that we built into our AccountingPRO™ Item List.

Project Management

Project Management- Client Management

- Fees & Insurance

- Design & Engineering

- Exterior Site Prep

- Demo & Interior Prep

- Temporary Facilities

- And the list continues through all of the major phases.

3. After you’ve decided on the primary job phases, decide the order in which you would like to see them displayed in reports and number them accordingly.

Tip: After checking in with various construction owners, we decided to set the AccountingPRO™ Item List to display the job phases. The resulting reports produced are then in “construction order”. You may wish to do the same thing.

4. Are there additional detailed stages that you’d like to track WITHIN the major job phases?

Here’s an example of various stages that we included under just one of our primary phases called “EXTERIOR TRIM”:

- Exterior trim (general)

- Deck trim

- Exterior wall finishes

- Siding

- Stucco

- Brick veneer

- Stonework

- Cornices/rake trim/fascia/soffit

- Exterior stairs

- Columns/railings/posts

- Shutters/window box

- Gutters & downspouts

- Mailbox, house number, etc.

- Other exterior trim

NOTE: Some estimators and company managers want to track a lot of detail, while others prefer less.

Using QuickBooks Items, you can pick out what’s “just right” for your construction company!

Using QuickBooks Items, you can pick out what’s “just right” for your construction company!

For example, in AccountingPRO™, we include many detailed job stages in the “Comprehensive View” version (one of four options). At the same time, you can also choose to inactivate Items you don’t currently need. That way, you can see exactly the amount of information that you’d like to track.

Alternatively, we also created an AccountingPRO™ option that we call the “Essentials View.” It’s for start-up businesses or companies that wish to see fairly summarized job costs and company reports. (AND there are two other options that you may want to check out!)

5. Decide when you might possibly use the following accounts within each construction stage.

For each of the detailed job stages you’ve identified, decide what type of account should display the results.

Why is this important? Because you will be creating separate Items and linking them to the “Cost of Goods Sold” accounts you have established.

- Direct labor costs for employees (if you have employees working on jobs)

- Contracted (subcontractor) costs

- Materials costs

- Other job costs (i.e., costs not covered by any of the above such as rental of equipment)

Tip: If you want to see and learn even more about this topic, see our construction accounting class #1600 – The Item List: Secret to QuickBooks Job Costing. You’ll find that it provides 72 minutes of in-depth, on-screen video and handout information that you need to know about Items.

You may also find class #1430 – Building Your Chart of Accounts (102 minutes) to be of value.

NOTE: Both of these “Level 1” classes are part of our extensive online QuickBooks video training series: Construction Accounting & Management Program (CAMP).

6. Set up your Item List (and Sub-Item List) in QuickBooks.

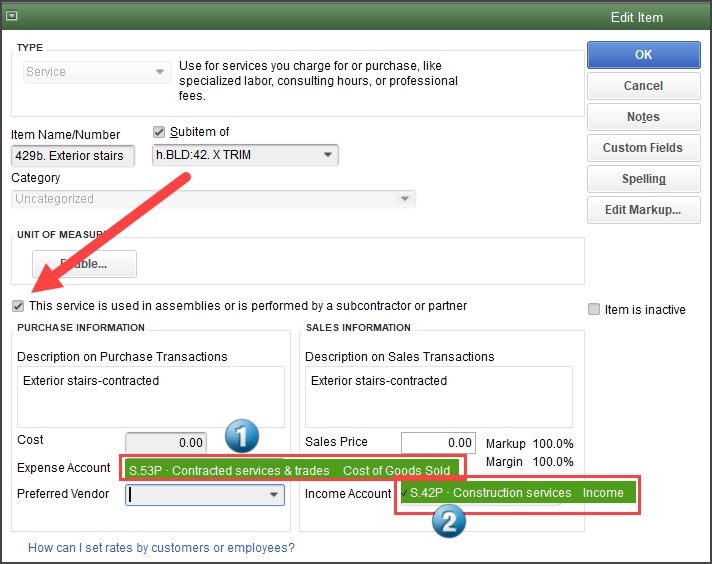

After you’ve finalized your entire list in a spreadsheet model, you can begin setting up your Item list using your primary phases as “Header Items” (e.g., the primary phase of Exterior Trim would be a Header Item). The more detailed stages that you have identified would become QuickBooks “sub-Items”. For our example below, “Exterior Stairs” is a sub-Item of “Exterior Trim”.

As you create each Item, you will click on the box that says, “This service is used in assemblies or is performed by a subcontractor or partner.” See the red arrow in the screenshot below.

Note from Diane:

I’ve always found this “QuickBooks description” to be confusing. Save yourself the bother of trying to understand the wording. Just ignore the description and click on the box! You will see the Item transform from a “single-sided Item” into a “double-sided Item.”

Here’s an example of an Item that uses the checkmark to create a double-sided Item that is a sub-item of Exterior Stairs. Below that, you will see a screenshot of all of the “sub-items” for “Exterior Stairs”.

What this accomplishes:

- When you use the Item for purchases, it will post the results to the correct cost account. (See #1 in the screenshot below.)

- If you use it in an Invoice or Sales Receipt, it will post the results to the correct Income account. (See #2 in the screenshot below.)

Here’s a screenshot that shows what a “set” of Items for Exterior Stairs would look like in the Item List after they have been established:

Get the PDF version of this article by clicking the following (no opt-in required):

QuickBooks Items: The Secret to QuickBooks Job Costing.pdf

Using QuickBooks Items for Job Costing

QuickBooks Items are one of the most powerful tools included within your QuickBooks desktop software. There are a variety of job costing and management reporting features included in the software as well.

Items are one of the most underutilized and most incorrectly used elements within QuickBooks!

In this article, I’ve done my best to provide a useful overview. I’m sure you’ll agree, however, that there are some fairly complex aspects involved in setting up a really useful Item List.

If you’d like to learn more about the “ins and outs” of Items and other behind-the-scenes construction and job costing secrets, I’d like to invite you to watch the videos that accompany AccountingPRO™.

Even if you don’t have an interest in this prebuilt construction template, the videos will help you see how QuickBooks can work. It can help you track your job costs and create those incredibly valuable Estimates vs. Actual Cost and Income reports.

Be sure to look for these specific topics and videos on this page:

- Items

- Chart of Accounts

- Reports (“standard” and management and job costing reports)

And, if you’d like to truly understand, apply, and enjoy the benefits of job costing, tracking, and monitoring for your company, you really should also take a look at what’s included in the Construction Accounting and Management Program (CAMP). You’ve got nothing to lose by looking – and potentially everything to gain!

Here’s to your ongoing journey to success – during which we know that YOU can create “Better Numbers for a Better Business”!

![]()

People Also Ask

FAQs (Frequently Asked Questions)

1. What are job costing Items in QuickBooks?

QuickBooks Items are elements you can create that will track details within transactions and display results in various Item-based reports. For example, in construction companies, you can create Items for specific prices or fees, employee or contractor services, materials, or other expenses. Items help you track detailed views of costs and income for jobs or projects within QuickBooks.

2. How do you create Items for job costing in QuickBooks?

To create Items for job costing in QuickBooks, navigate to the Items List, select New Item, choose the type of Item (such as Service, Inventory Part, Non-Inventory Part), and enter details, including cost and sales price. (See the explanation in section 6. “Set up your Item List (and Sub-Item List) in QuickBooks” of this blog article regarding double-sided Items.)

3. Why is it important to use Items in QuickBooks for job costing?

When you use Items, you can more accurately estimate and track costs associated with each job or project. When you use Items to enter transactions, you can create reports for detailed cost analysis and profitability assessment. Items will also assist with accurate invoicing.

4. What is the difference between service items and inventory Items in QuickBooks job costing?

Service Items can be used to track services and various project costs that are NOT related to inventory purchased and used for jobs.

Inventory Items are designed to show costs for inventory purchased and subsequently sold or used for projects. You can use either or both Item types to accurately calculate job costs in QuickBooks.

5. How can QuickBooks Items help in managing project profitability?

QuickBooks Items provide a detailed way to see estimates, income and costs associated with each job. These insights allow each business to adjust pricing strategies, manage estimates, and improve overall project profitability.

6. What are some best practices for setting up Items in QuickBooks for job costing?

Best practices include creating headers for major stages within individual jobs, arranging the headers in job-completion order, using consistent naming conventions, accurately linking Items to appropriate income and cost accounts and sales tax status, regularly updating Item details, and training staff on proper Item usage.

7. How does QuickBooks handle overhead costs in job costing?

After determining the correct burden percentage(s) to use for employees, you can program QuickBooks to automatically compute and enter labor burden costs to jobs by using the free QuickBooks Payroll Module.

8. What are some challenges businesses face when using QuickBooks Items for job costing?

Challenges include creating the correct types of Items, logically organizing the Items, and correctly linking Items to the correct Income and Cost accounts. Additionally, it’s important to ensure that as new Items are added, they are necessary and correctly coded and that existing Items have been altered only based on approval approvals.

9. Can QuickBooks Items be customized for specific job types or industries?

Yes, QuickBooks allows customization of Items to suit different job types or industries. This customization facilitates tailored cost tracking and reporting based on specific industry and project requirements.

10. Where can I find more resources and guides on using QuickBooks Items for job costing?

Additional resources and guides are available on the Build Your Numbers website.

![]()

Customer Praise For Diane Gilson, Info Plus Consulting, and BuildYourNumbers.com

⭐⭐⭐⭐⭐ From the Intuit FindAProAdvisor website:

“I like Diane’s approach. No wasted time. She listens, she talks. After weeks of me working through issues, this really helped to polish things up. Highly recommended! Thank you!”

See More Customer and Client Comments