How Percentage of Completion Entries Fix Revenue Fluctuations for ‘In-Process’ Contracts

The Problem with ‘In-Process Contracts’

The Problem with ‘In-Process Contracts’

Custom builders and project-based firms often invoice per contract stages over extended periods, from several months to over a year. As a result, income is nearly always booked either:

- Before costs are entered into your accounting system and/or

- After costs are incurred or entered

However, job costs are usually incurred and entered into the accounting system on an ongoing but fluctuating basis. As a result, you’ll see a mismatch between what has been invoiced and what has been earned.

Why is this a problem?

One month, you may have lots of income on a job but not much in terms of cost.

The next month, you may have little or no income but lots of costs.

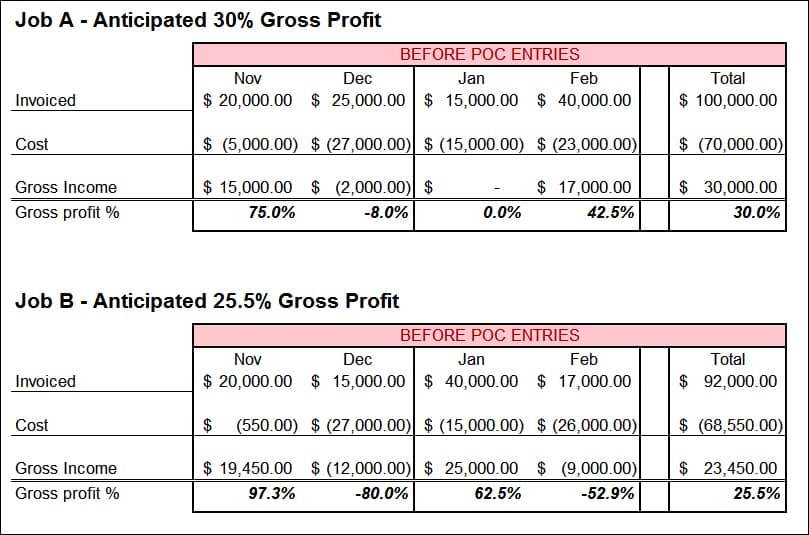

The result? A monthly ‘see-saw’ effect on your gross profit results! (See below for 2 examples):

Looking at the results above, you’ll notice that no single month reflects the true Total job profitability (30% for Job A and 25.5% for Job B). Each month, viewed in isolation, shows wildly varying and unrealistic profit or loss. If you have a need to know how a job – or the company – is doing, this could create quite the emotional roller coaster!

More importantly, with Bills, Checks, Payroll, Invoices, and cash coming and going, it’s virtually impossible to know how much you are truly EARNING on a day-to-day, week-to-week, and month-to-month basis on any specific long-term job. Of course, if you have a good job costing accounting system, you will eventually know your final results on any given job, but that’s far too late to take corrective action.

How is each Job doing?

You have to know consistently how each job is performing in relation to budget if you want to control your profitability. You simply can’t wait until each individual job is done.

With a multitude of projects running at the same time, it can become nearly impossible to nail down your company-wide financial scores for any given time frame!

Think of this like using a level – as you build, you’re constantly checking to make sure each part of what you’re building is level. If you wait to apply the level until after the project is done, you’ll be ripping out and redoing a lot of work.

Financially, that’s where Percentage of Completion adjustments come into play.

Percentage of Completion adjustments to the rescue!

The ‘Percentage of Completion adjustments’ technique provides you with a stable, reliable way of matching each job’s life-to-date revenue against its life-to-date expenses. The POC adjustments mean that you can see how this month’s (or quarter’s) profit “lines up” against last month’s, last quarter’s, or last year’s. And if your job profitability reflects reality, your company-wide numbers will more clearly reflect reality.

The ‘Percentage of Completion adjustments’ technique provides you with a stable, reliable way of matching each job’s life-to-date revenue against its life-to-date expenses. The POC adjustments mean that you can see how this month’s (or quarter’s) profit “lines up” against last month’s, last quarter’s, or last year’s. And if your job profitability reflects reality, your company-wide numbers will more clearly reflect reality.

How is it done? Your income is adjusted up or down each month so that the income earned corresponds to costs incurred. For example, if you anticipate a 30% gross profit on a job, and life-to-date, you have incurred 60% of the costs on a job, your income is adjusted to reflect 60% of your anticipated income.

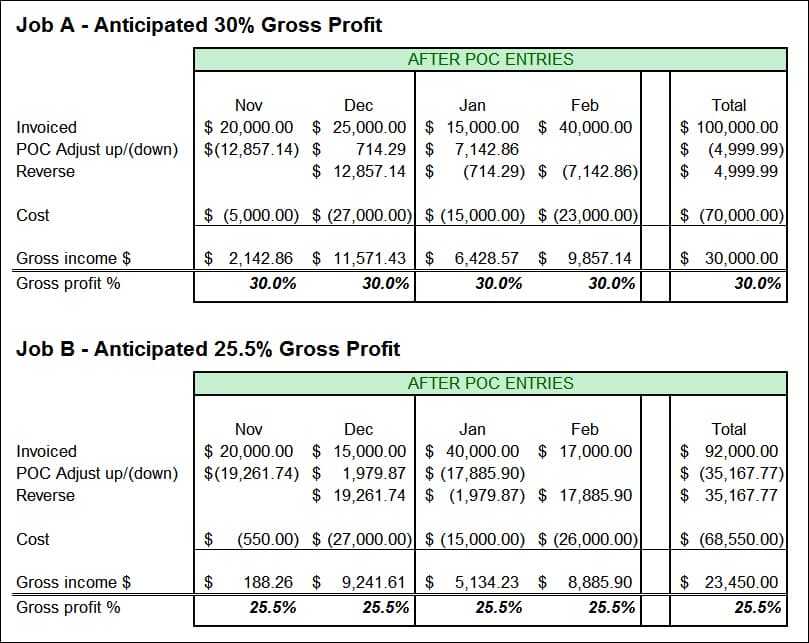

The result: you’ll see your anticipated gross profit reflected each month that the job is open. Simply stated, the entries provide a way to “level” your financial results across accounting periods. Please see the example below that illustrates how the income looks for Jobs A and Job B AFTER Percentage of Completion adjustments.

Quite a difference in what you see each month, isn’t there? (Be sure to compare the ‘before and after’ pictures…)

As you’ll see from the results above, Percentage of Completion (POC) entries act much like the bubble in a common level (i.e., you temporarily adjust revenue for individual jobs to proportionally match costs incurred. You adjust and then reverse your entries at the end of each month.)

Remember, The Percentage of Completion Accounting Method May Be Required

Because the percentage of completion method offers clear insights into production and earnings, many organizations require POC calculations and adjustments:

- Various national consulting groups (so participants can compare true productivity and profitability with other participants).

- Many bonding companies

- Banks who track company profitability on their borrowers

- The IRS – for businesses above a certain gross revenue level (see your tax advisor or this IRS article for specifics).

(NOTE: Despite tax requirements, the percentage of completion method yields the best management info for long-term jobs. Why? It matches costs incurred with income earned. You can use the POC method for internal reports, even if your tax advisor uses another method.)

Extra Percentage of Completion Benefits – Especially for Owners & Managers

In addition to seeing ‘smoothed out’ gross profits on jobs and more realistic bottom-line management reports, you should also reap the following bonuses:

- As you compile data for Percentage of Completion calculations, you’ll gain insight into key financial metrics. E.g., you’ll see estimated income and costs, change orders, allowances, and over/under-runs.

- You will gain a much deeper understanding of exactly how individual jobs are shaping up financially as they progress. From there, you can swiftly adjust to finish jobs on time and under budget.

- When you evaluate key players using accurate financial criteria, they naturally work to enhance their results!

- Accurate financials make obtaining construction financing easier by better reflecting your true financial situation.

- When you know what your numbers really are, you can save the ‘rollercoaster’ thrills for the amusement park. When you run a company, a nice, smooth train ride is preferable…

Percentage of Completion Works!

Yes, it will require a small investment (less than $1,000) to get your Percentage of Completion adjustments ‘up and rolling,’ but the payoffs are significant.

If you:

- Have experienced those fluctuating numbers.

- Need to continually guess what’s still coming in the door for ongoing jobs.

- Experience ongoing discomfort because you don’t know where you stand on a job until after it’s completed.

- Sense that your finances are out of control because you don’t know where your company really stands.

It’s time to move these adjustment techniques and reporting improvements to the top of your list!

Discover the Info Plus tool that helps you see more about your month-to-month profitability!

The Percentage of Completion Analyzer™ helps you easily create Percentage of Completion calculations and adjustments.

Click the link above for more info – or for further assistance, contact us at 734-544-7620 (9-5 Eastern, M-F).

Customer Praise For Diane Gilson, Info Plus Consulting, and BuildYourNumbers.com

⭐⭐⭐⭐⭐

From the Intuit FindAProAdvisor website:

“Diane has provided incredible insight to the processes we created. She gave critical guidance that assisted our CPA as well as our procurement and accounting team. Diane would receive a rating of 5+++++++. Tremendous asset to our company.”

See More Customer and Client Comments