How Much Are You Losing by NOT Performing Underbilling Calculations for Employee Time?

This Free Calculator Helps You Estimate!

Underbilling for Employee Labor? Here’s what that’s costing you!

Free Calculator that illustrates underbilling calculations…

Here’s a free calculator to help you do the math. If you are underbilling for employee labor, use it to discover how much revenue you may lose over 1, 3, and 5 years.

Just enter four numbers in the yellow cells below to show your results.

(I’ve also added examples and other notes below the calculator.)

How to use this free calculator:

- Enter Your Estimates in the Yellow Cells ONLY. Start with Annual production Hours per Worker. (Entering data in other cells will invalidate the results).

- To start over, refresh the page. . .

- If you’re not sure how much you may be undercharging per hour, or you’re not clear about your annual production hours, the examples shown below the calculator may be helpful…

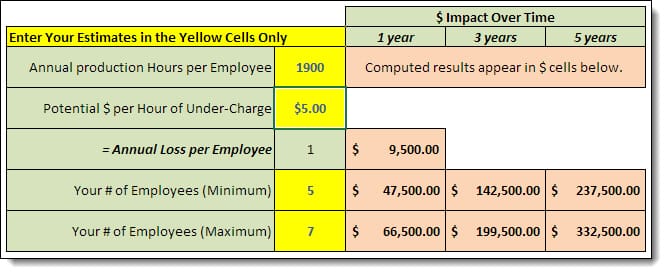

Example: Underbilling Calculator Example #1:

Every company’s estimates will vary, but here’s a screenshot of what the calculator would show if we entered estimates of:

- 1,900 hours per year of average “production” time. (2,040 available work hours + overtime, (-) all paid time off, and other ‘non-production’ time such as company meetings, timesheet prep, non-job breaks, and other ‘non-job’ time.)

- Estimated average underbilling of $5 per production hour.

- From 5 to 7 revenue-earning (‘production’) employees.

…Results Show a 5-Year Revenue Loss of $237,500 to $332,500!

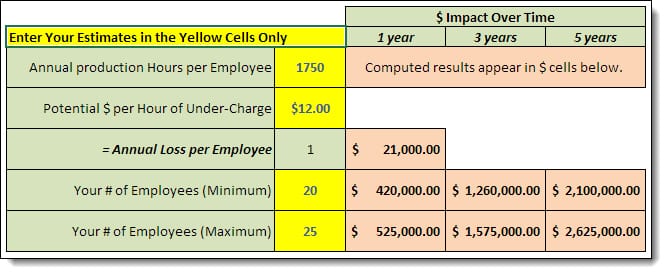

Example: Underbilling Calculation Example #2:

Changing the variables has a different impact on lost revenue. For this example, we’ve entered estimates of:

- 1,750 hours per year of “production” time - including overtime. (Many service workers have less time assignable to jobs, so we show fewer annual project hours.)

- Estimated underbilling of $12 per production hour.

- From 20 to 25 revenue-earning (‘production’) employees.

= 5-Year Revenue Loss of $2.1 to $2.6 Million!

Of course, the numbers get proportionally larger for larger companies with more employees!

What the Labor Underbilling Calculation Reveals...

- You may start out with what looks like a fairly small hourly underbilling difference. But, when multiplied by a number of employees over several years, it can amount to a staggering loss of revenue!

- This revenue reduction flows directly to your bottom line (or, more importantly, every cent you underbill does NOT flow to your bottom line!)

- You can imagine that these reductions can ultimately determine a company’s long-term success or failure.

"Fully-Burdened Labor Cost"

I.e., what it costs an employer for an employee to produce work for a specific period of time...

(...usually shown as a "per-hour" rate.)

Click the image above to learn more about our Excel-based tool that will help you learn everything you need to know about your employee costs and billing rates...

Could YOU Be Underbilling?

If there is a possibility that you might be underbilling, please take a few moments to enter some estimates into the free calculator at the beginning of the article to see the potential impact on YOUR company’s revenue (and bottom line).

If you’re in doubt about “Annual production hours per employee” or “Potential $ per hour of undercharge” (the first two cells in the underbilling calculation), please be sure to consider the following...

Do you know:

- Your annual production hours per employee?

- What each employee really COSTS per production hour?

- How much per hour you SHOULD charge (or build into your project costs) to hit your gross profit goal for employee labor?

- Based on those results, how much per hour are you currently underbilling?

Now that you see the huge effect labor under billings can have on your revenue, click on any of the above links to look at a unique resource we’ve developed to help you determine exactly what those underlying numbers look like for YOUR company. You’ll find these videos and information to be both informative and eye-opening...

![]()

People Also Ask

FAQs (Frequently Asked Questions)

1. What is underbilling for employee labor?

Underbilling refers to the situation where the amount billed to a client or customer for services rendered is less than what you should be billing for their time. The amount you SHOULD bill would be enough to cover all of your employee-related costs PLUS the markup on their costs you need to earn to earn a profit for your company.

2. How do you perform an underbilling calculation for employee labor?

Underbilling is calculated by first determining the entire cost per hour that your employee costs. Then add the amount per hour ABOVE those costs that you need to earn in order to earn the gross profit on employee labor that you need to earn. The total is what you SHOULD bill for each hour of employee time. For example, is your employee's total, fully burdened labor costs is $40 per hour, and you need to add 40% markup, you should charge at least $56 per hour to meet your markup goals. If you are only charging $50 per hour for their time, it means that you are UNDERBILLING by $6 per hour.

3. What are the causes of underbilling for employee labor?

Causes of underbilling include not performing fully-burdened cost calculations, failing to adjust those cost calculations as circumstances change, not adding the right markup to ensure profitability on employee labor, and using "what the competitor charges" for labor rates rather than determining billable rates based on actual costs and markup goals.

4. Why is it important to monitor underbilling for employee labor?

The impact of underbilling for employee labor can add up quickly! The tables shown in the blog article illustrate how a few dollars of underbilling per hour multiplied by your number of employees multiplied by the number of job or project hours worked by each employee can create large amounts of underbilled revenue! The annual amounts are large, and the amounts viewed over a number of years can be staggering...

5. How can QuickBooks help in underbilling calculations for employee labor costs?

QuickBooks allows businesses to use accounts to track the many costs that contribute to fully-burdened employee labor costs. After you use those numbers to compute your fully burdened labor costs, you can use the QuickBooks (free) Payroll Module to assign fully burdened costs to jobs. You can then compare the amount you have billed for employee labor against your fully burdened costs to see if you have met your markup goals for your employee labor for each Job or project.

6. What strategies can be used to minimize underbilling for employee labor?

Strategies include:

... Update your labor burden cost estimates throughout the year

... Ensure that employees track their time accurately

... Implement effective project controls, reports, and internal communications

... Monitor labor time and course-correct labor over runs immediately to ensure that you can bill for employee time as estimated.

7. What are the consequences of persistent underbilling for employee time?

Consequences include reduced profitability, inability to provide benefits or raises to employees, higher employee turnover, strained cash flow, delayed payments to vendors, and potential damage to the business's reputation.

8. How does employee labor factor into underbilling calculations for the entire company?

Employee labor costs contribute to underbilling calculations as they represent a significant portion of project expenses that need to be accurately charged when billing clients.

9. What role does accurate time tracking play in preventing underbilling?

Accurate time tracking ensures that all billable hours are accounted for, reducing the risk of underbilling and helping businesses optimize resource allocation and project profitability.

10. Where can I find more resources and guides on underbilling calculation and employee labor management?

Additional resources and guides are available on the Build Your Numbers website.

![]()

Customer Praise For Diane Gilson, Info Plus Consulting, and BuildYourNumbers.com

⭐⭐⭐⭐⭐ From the Intuit FindAProAdvisor website:

“We have worked with Diane since 2007, when we installed QuickBooks as our accounting system. She has walked us through set-up, taught us how to use QB, and does monthly follow up to make sure everything is going as it should. We are a manufacturing company with inventory, and we also do our own payroll. We have given Diane numerous problems to solve, and she has figured them out in no time. She is very personable, reliable, and easy to work with, and I look forward to working with her every month.”

See More Customer and Client Comments