Labor Burden Information Tip #3:

To See Accurate Job-Cost Reports, Assign Labor Burden Costs to Each Job.

If you’re looking for ways to make your company more profitable, getting a handle on your fully burdened labor costs is a critical place to start because it can show you how to:

If you’re looking for ways to make your company more profitable, getting a handle on your fully burdened labor costs is a critical place to start because it can show you how to:

- Estimate labor costs more accurately,

- Price jobs to yield the gross profit percentage you deserve to make, and

- Monitor and manage your TRUE labor costs as each job progresses.

With this information at hand, you will be in a position to understand and improve your gross profit for each and every job that you take on.

BUT, if you haven’t already been assigning labor burden costs to each job in your accounting reports, you may be asking “why should I start now?”

It’s because job-cost reports that are missing labor burden costs are actually misleading. Why? Because they don’t really reflect your true cost of labor.

EXAMPLE:

To illustrate this point, I’ve created an example of a “before” and “after” job-cost report so you can see an example of how this works.

As you look at the comparison below, you’ll see that the job-by-job profitability results are very different!

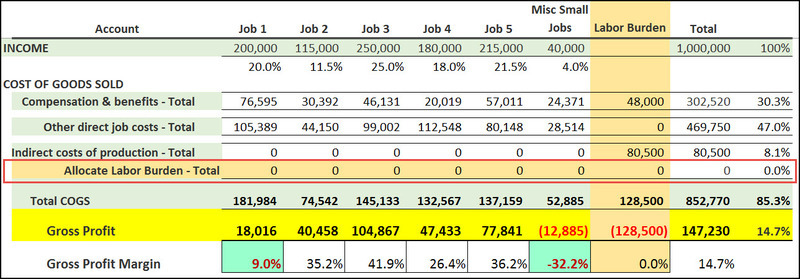

Sample A – Results BEFORE Burden Allocations

…

…

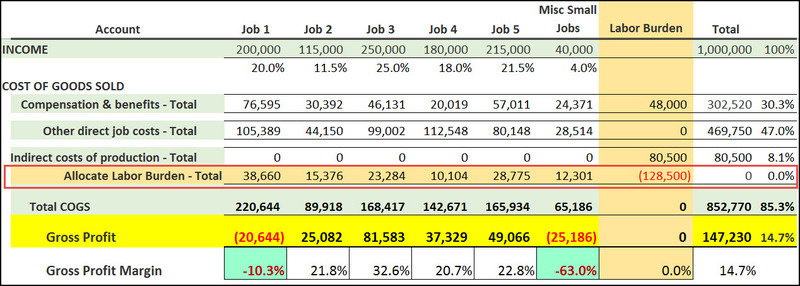

Sample A – Results AFTER Burden Allocations

By moving the labor burden costs into each job (highlighted in the red box), you can see the impact this has on the gross profit amount per job (highlighted in yellow). You can also see that the gross profit margin for each job changes as well (shown as percentages below the Gross Profit dollar amounts).

For instance:

- Job 1 had a gross profit of $18,016 and a Gross Profit Margin of 9% before the allocations, but has decreased to a loss of -$20,644 and -10.38% after the allocations.

- Job 2 had a gross profit of $40,458 and a Gross Profit Margin of 35.2% before the allocations, but profitability has decreased to $25,082 (21.8%) after the allocations.

…

Click here to see a Labor Burden Calculator (eCPA employee Cost & Pricing Analyzer™)

WHAT THIS MEANS TO YOU

Let’s assume this is your business and that 20% is your desired Gross Profit.

If you, as a business owner, focused on the job results BEFORE the allocations, you might believe (with the exception of “Misc. Small Jobs”) that you were doing pretty well on your job profitability, right?

BUT, in total, you’re not doing as well as you’d like because of the $128,500 of burden cost NOT assigned to jobs.

The gross profit margin for the entire company shown in the example above is 14.7% (too low). It’s the same in both examples, but by re-assigning (allocating) the labor burden out to jobs, and comparing the results, we can see that our initial profitability by job was actually very misleading!

In fact, you see a much more accurate picture of the true profitability for each job AFTER the labor burden is assigned out to jobs

WHAT TO DO WITH MORE ACCURATE REPORTS?

Some ideas of how you can act on the information you see in these more accurate (fully-burdened) job-cost reports include:

- Determine the cause of losses or poor profitability (e.g., cost estimating errors, pricing that was not high enough, poor job management, overlooked invoicing on Change Orders, only occurring on certain types of jobs, etc.).

- If low profitability or losses are coming from certain types of jobs, you can either look at ways to make them more profitable, OR it may be wiser to stop doing them altogether.

- Find ways to bring identified labor overages back into alignment by changing “who does what” or by providing additional insights or training for your people.

As a business owner, you need accurate information to make better decisions about how to run your enterprise. Using fully burdened labor costs in your job-cost reports will give you the REAL gross profit numbers you need to ask smarter, better questions and run a more profitable company.

Because a strong economy provides greater wealth for everyone, feel free to share this information with your business friends or vendors. Why? Lots of companies don’t know how much their employees really cost. With this information, you could provide them with info to assist with better business decisions. You could even be helping them to stay in business!

Reminder:

- Click here to access a Labor Burden Calculator (eCPA employee Cost & Pricing Analyzer™).

… - Have you had a chance to run some of your own numbers? If so, what’s the FIRST way you’ll use your information? To share your insights, please email me from our Contact Info Plus Consulting page …

This is one of a series of useful tips that show how you can add to your bottom line when you know each employee’s true hourly cost!

Disclaimer: All numbers presented herein are theoretical and should not be construed as industry averages. You will need to use your own eCPA to see your own company’s true, fully burdened costs.

Related Articles: Part 2 | Part 4

Customer Praise For Diane Gilson, Info Plus Consulting, and BuildYourNumbers.com

⭐⭐⭐⭐⭐ From the Intuit FindAProAdvisor website:

“I have had Diane address the most challenging of accounting problems that I face as a small business owner. Her grasp of the issue at hand is almost immediate, and her collaborative approach makes arriving at elegant and relevant solutions almost inevitable!”

See More Customer and Client Comments