How To Make Sure You Always Hit Your Profit Goals

Labor Profit Tip #2: Achieve Desired Profit Margins By Knowing Your Fully-Burdened Costs

Fully-Burdened Labor Rate

The fully burdened labor rate is a calculation used by businesses to account for the complete cost of employing an individual. It includes not only the basic salary or wage paid to the employee but also all the indirect expenses that are associated with employment.

The fully burdened labor rate is a calculation used by businesses to account for the complete cost of employing an individual. It includes not only the basic salary or wage paid to the employee but also all the indirect expenses that are associated with employment.

These indirect costs can include benefits, taxes, insurance, equipment, facilities, training, and administrative costs. By understanding the fully burdened labor rate for each employee, you can create more accurate bids and make better-informed decisions.

The Importance of Knowing The Fully-Burdened Labor Rate for Each Employee

One of the most important factors in ensuring and maintaining construction company profitability is knowing your accurate, fully-burdened labor rate and building that fully-burdened cost into your bids.

The True Cost of an Employee

The fully burdened labor rate shows you the true cost of each employee. Without knowing this and accounting for it in your bids, you are not reflecting the costs you absolutely have to pay in your bids, resulting in reduced profits for your company.

In this article, I’ll give you an example of how using correctly burdened labor rates in your bids and accounting will improve your profitability, and I will provide you with a link to worksheets that allow you to easily calculate your fully burdened labor rates.

You will discover what you need to charge (or earn) per hour for employee time when you:

- Use your employee Cost & Pricing Analyzer™ (eCPA) – a labor-burden calculator showing you the true cost of an employee – to determine your true (fully burdened) cost of labor for each classification of employee.

- And apply your desired gross profit margin.

You can then create an Estimate, Quote, or Bid that will not only cover your true employee costs – but will create the profit that you deserve to earn from each job.

Click here to see a Labor Burden Calculator (eCPA employee Cost & Pricing Analyzer™)

Example Fully Burdened Cost Calculations:

How Different Labor Burden Rates Impact Billings & Annual Profit Margins

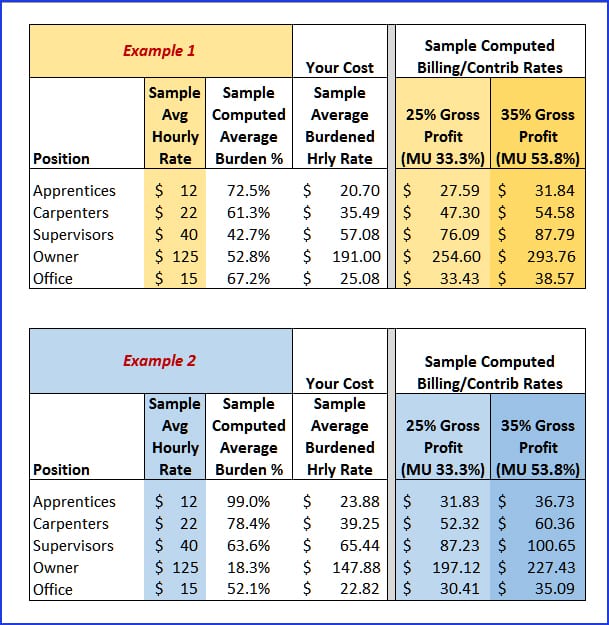

To help illustrate, I’ll create a scenario in which a client has two different companies (Gold and Blue).

- One of the companies handles kitchens, baths, and additions.

- The other company focuses on remodeling and restoration.

Let’s say that the owner has asked me to help the companies (collaboratively) determine how much they should be earning for their employees’ time. (This is one of the services we offer, by the way. Contact us for more information.) Here’s what I’ve learned (and the color-coded chart that I made) to help understand their different situations.

Fully-Burdened Rate Assumptions:

- Each company has the same types of employees, and each type of employee is paid the same hourly amount. (For example, you’ll see that they both pay Apprentices $12 per hour and Carpenters $22 per hour.)

… - They’ve used the eCPA, our fully-burdened labor rate calculator, to compute their burden percentages and fully burdened costs for each employee classification. (Yes, those percentages and resulting costs per hour are different; see below.)

… - They’d like to see what billing (earning) rates for labor would look like for each company for both 25% and 35% gross profit margins.

We’ll compare how burdened costs and billing amounts compare based on:

- Different Burden Percentages

- Gross Profit Targets

Exploring Fully-Burdened Hourly COST Differences For a Single Position

To begin to analyze the results, we decided to start by focusing on just a single position: Carpenters.

- Because Carpenters in the Gold Company have a burden percentage of 61.3%, their burdened cost to the company comes to $35.49 per hour.

- Carpenters in the Blue Company have higher costs, so they have a higher burden rate of 78.4%. This means their burdened cost to the company comes to $39.25 ($3.76 per hour difference).

$3.76 per hour doesn’t sound like a huge amount, right? But see what happens when we convert these differences into hourly and annual billing rates.

Determining Fully-Burdened Hourly Employee BILLING Differences…

Now, let’s compare Billing Rates for 25% and 35% gross profit targets:

- To achieve a 25% gross profit margin on labor, the Gold Company will bill out their Carpenters for $47.30 per hour.

- To hit a 35% gross profit margin, the hourly billing rate would be $54.58: $7.28 more per hour than if they were trying to achieve a 25% gross margin (15.4% above the 25% gross profit target).

Now that they see their fully burdened numbers and marked-up results, the Gold Company will be able to set their billing rates so they can hit their profit targets on Carpenter labor.

The Blue Company determines that:

- Because their cost structure is higher, their burden rate is higher, so they will need to charge $52.32 per hour to achieve a 25% gross profit ($5.02 more per hour than the Gold Company).

- To make a 35% gross profit, they will need to bill out Carpenters at $60.36 per hour ($5.78 more per hour than the Gold Company).

With this information, the Blue Company will also be able to decide what they should be charging for their Carpenters’ time.

Computing ANNUAL BILLING RATES & DIFFERENCES for Multiple Employees in a Specific Position

Now, let’s assume 1,850 hours per year of fully burdened hourly billable work. How much would the Blue Company need to bill out per year to achieve its goals? Let’s do the math:

- For a 25% Gross Profit Margin: 1,850 hours x $5.02 = $9,287 PER CARPENTER. If they have 3 Carpenters, they’ll need to bill out $27,861 more per year than the Gold Company.

… - For 35% Gross Profit Margin: 1850 hours x $5.78 = $10,693 PER CARPENTER. If they have 3 Carpenters, they’ll need to bill out $32,079 more per year than the Gold Company.

Fully Burdened Labor Costs Are the Foundation of Profitability…

By walking through the numbers one step at a time, we can see that the driving force behind establishing profitable pricing – for each company – starts with knowing their employees’ fully-burdened hourly labor costs.

Pricing Changes Based On Fully-Burdened Labor Rates

Many people who have performed these calculations find that they need to adjust their pricing. In some cases, they need to increase rates, and in others, they find that they can reduce their prices to be more competitive.

- Have you had a chance to run some of your own numbers? If so, what’s the FIRST way you’ll use your information?

- Are you confident in your current pricing? Or could your numbers use a “look-through”?

- To share your insights, please email me from our Contact Us page …

Advantages of Knowing Your Fully-Burdened Labor Rates

Knowing your fully-burdened labor rate is critically important for businesses because it is the foundation of:

1. Accurate Cost Estimation

Knowing your fully burdened labor costs allows for more accurate cost estimation when bidding on projects or contracts. By factoring in all the labor-related expenses, a business can ensure that it charges a price that covers all costs while maintaining profitability.

2. Pricing Strategy

Without knowing your burdened costs, you cannot set competitive and sustainable prices for products or services. Understanding the fully burdened labor rate enables a business to establish pricing strategies that consider both direct and indirect labor costs, ensuring that prices are neither too low to cover costs nor too high to deter customers.

3. Profitability Analysis

Knowing their fully burdened labor rate allows you to assess the profitability of individual projects, products, or services. This analysis helps identify which aspects of the business are most profitable and where improvements or cost reductions may be needed.

4. Budgeting and Financial Planning

It aids in effective budgeting and financial planning by providing a comprehensive view of labor-related expenses. This information is essential for allocating resources, setting financial goals, and making informed decisions about hiring and expansion.

5. Resource Allocation

Accurate burden rates enable you to make informed decisions about how to allocate your workforce and resources. By understanding the true cost of labor, you can allocate employees to projects or tasks where their skills are most needed and cost-effective.

6. Negotiation and Contracting

When negotiating contracts or agreements with clients or suppliers, having a clear understanding of your fully burdened labor rate provides a strong foundation for negotiations. It helps ensure that contracts are fair and mutually beneficial.

7. Do the Work Yourself vs. Sub-contract Decisions

Knowing your fully burdened rates gives you additional information to help in the decision as to whether to have your own team do a portion of a job or sub-contract that out to another team. If you’re only comparing your unburdened costs with their bid, you may make a totally different decision versus knowing that your real costs come in higher than their bid.

8. Performance Evaluation

It provides a basis for evaluating employee and project performance. By comparing actual labor costs against budgeted labor costs, businesses can identify areas where efficiency improvements may be necessary.

9. Cash Flow Management

Understanding your burdened labor costs helps in managing cash flow effectively. Businesses can anticipate when peak labor-related expenses will occur and plan accordingly to ensure they have the necessary funds available.

10. Competitive Advantage

A clear understanding of your fully burdened labor rate can provide a competitive advantage. It allows a company to offer competitive pricing while maintaining profitability and making informed decisions that contribute to long-term success.

In summary, knowing your fully burdened labor rate is crucial for financial stability, informed decision-making, and competitiveness in the market. It ensures that a business operates efficiently, maintains profitability, and meets its financial and operational objectives.

Disclaimer: All numbers presented in this article are theoretical and should not be construed as industry averages. You will need to use your own eCPA to see your own company’s true, fully-burdened costs.

![]()

People Also Ask

FAQs (Frequently Asked Questions)

1. What is a fully burdened labor rate?

The fully burdened labor rate includes the employee’s salary or wage plus all indirect expenses such as benefits, taxes, insurance, equipment, and administrative costs.

2. Why is knowing the fully burdened labor rate important for profitability?

Using a fully burdened rate means that you’ll include all employment-related costs in your bids, helping to prevent under-estimating (under-bidding) by ensuring your estimate (and resulting price) covers all labor-related costs. Accurate estimating leads to better profitability.

3. How do I calculate my fully burdened labor rate?

Use tools like the employee Cost & Pricing Analyzer™ (eCPA) to sum all direct and indirect costs and divide by the total labor hours to get the rate. You can then use the tool to enter your desired gross profit margin to determine your desired labor rate.

4. How does the fully burdened labor rate impact job pricing?

It helps set accurate and competitive prices by ensuring all labor-related costs are covered, which helps in achieving desired profit margins.

5. What components should be included in the fully burdened labor rate?

Components include gross pay, benefits, payroll taxes, insurance, training costs, equipment, facilities, and administrative expenses. You may also wish to include other costs such as the cost of supervision.

6. How does the fully burdened labor rate affect decision-making?

It provides a clear picture of labor costs, which aids in estimating, financial planning, resource allocation, and competitive pricing strategies.

7. Can I use my fully burdened labor rate for different types of employees?

Yes, you should calculate the rate for each employee (or classification of employee) to ensure accurate cost tracking and pricing. You can use the employee Cost & Pricing Analyzer™ (eCPA) to compute fully burdened costs and burden percentages for individual employees and employee classifications.

8. What are the benefits of using a labor burden calculator like the eCPA?

As a one-time purchase, it simplifies the calculation process, ensures accuracy, and provides detailed insights into employee costs, which helps you set profitable billing rates. Additionally, it includes instructions about how QuickBooks desktop users can use the (free) payroll module to automatically post the labor burden data entries, and it’s easy to update on a monthly, quarterly, or annual basis.

9. How often should I review and update my fully burdened labor rates?

Regularly review and update the rates to reflect changes in costs such as benefits, taxes, and overhead expenses. We suggest a monthly “check-in-for-major-changes,” a quarterly walk-through and refinement as needed, and a thorough update each year.

10. Where can I find more resources on calculating and using fully burdened labor rates?

Additional resources and detailed guides on calculating and using fully burdened labor rates are available on the Build Your Numbers website.

![]()

This is one of a series of useful tips that show how you can add to your bottom line when you know each employee’s true hourly cost!

Read the other related articles in this series:

- Part 1- Labor Profit Tip #1: For More Accurate Job Estimates, Include Fully-Burdened Labor Costs for Each Employee

- Part 3 – Labor Profit Tip #3: Your Gross Profit numbers may be misleading

How to Calculate Your Fully-Burdened Rates:

“Fully-Burdened Labor Cost”

I.e., what it costs an employer for an employee to produce work for a specific period of time…

(…usually shown as a “per-hour” rate.)

Click the image above to learn more about our Excel-based tool that will help you learn everything you need to know about your employee costs and billing rates…

What our customers say about Diane Gilson and Info Plus Accounting:

⭐⭐⭐⭐⭐ From the Intuit FindAProAdvisor website:

“Diane assisted us in creating a solution to import credit card transaction activity from third-party file. This was not just for us, but a large group of our customers that are QuickBooks users. Diane’s instinct on best practices was terrific. She interfaced extremely well with our customers. She assisted in drafting a users guide to the function. During the process Diane was reliable, responsive, efficient with our time, and professional the whole way. I couldn’t have been more pleased with the engagement.”

See More Customer and Client Comments