Yes, your initial QuickBooks payroll setup can take some time and requires attention to detail. BUT manual payroll processing requires even more work – and you have to do it over – and over – and over…

Which sounds like the better choice?

QuickBooks Payroll

Ask any 10 small and mid-sized business (SMB) bookkeepers and company owners which element of their accounting tasks they’d like to shed, and chances are that eight of them would say “payroll.”

Paying employees can be stressful. Not only does it require precision and “money out the door,” – but you also have to deal (accurately!) with multiple taxing agencies (including the IRS).

How QuickBooks Payroll Makes Payroll Easier

The QuickBooks Payroll system is designed to:

Make your ongoing payroll prep significantly easier

Make your ongoing payroll prep significantly easier- Remove most of the burden of processing payroll reports and making the associated tax payments

- Help you compute and track employee benefit programs and contributions

- Enhance your understanding of the entire payroll process

- Solve multiple payroll-related problems.

Using QuickBooks Payroll, you can:

-

-

Assign each employee’s payroll, payroll taxes (and even labor burden!) costs to jobs and to job tasks.

-

Result: Job costing reports that reflect employee labor costs. You can use the built-in QuickBooks timesheets to initially enter information and then direct it to create the paychecks and related job costing assignments (the easiest way). Alternatively, you can enter the employee’s jobs and tasks directly into the QuickBooks paycheck screen.

If you want accurate job costing reports and need to include employee payroll and related costs, take a look at this (72-minute) class: Overview & Concepts: Time Tracking & Payroll (1630/Level 1).…

-

-

QuickBooks Payroll enables you to offer direct deposit to employee accounts to make their life easier.

Alternatively, you can choose to print payroll checks on check stock to hand to employees.

-

QuickBooks Payroll automatically keeps employee information organized.

-

You’re probably well-acquainted with the mounds of paperwork that have to be filed for new employees. QuickBooks Payroll helps ensure that you obtain all of the information that’s required by your company, your financial institution, and taxing authorities. Once entered, it’s always easily accessible and ready for use as you prepare payroll runs.

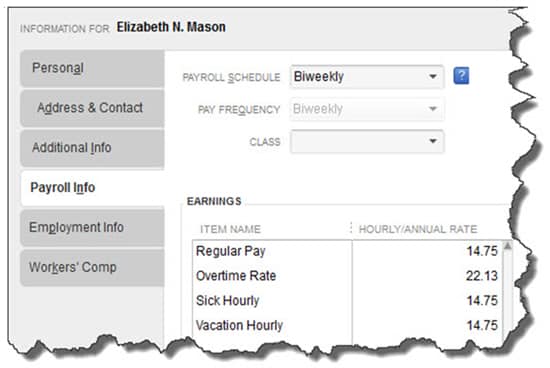

Figure 1: QuickBooks stores the voluminous employee-related details

Figure 1: QuickBooks stores the voluminous employee-related details

you’ll need when it comes time to process payroll.

-

-

Track and administer company benefits and Workers’ Compensation Insurance.

-

You know that generous benefits can both attract potential hires and contribute to overall job satisfaction. But the administrative aspect can quickly become very complicated.

The QuickBooks Payroll Setup Tool uses a simple wizard to walk you through the process of entering all of the details required to define them, withhold pay where necessary, and keep up with timely payments to outside agencies.

…

Employees receive detailed pay stubs that spell out contributions made toward:

– Insurance (health, dental, life, Health Savings Account, etc.)

– Retirement (401(k), IRA, etc.)

– Paid time off, and

– Miscellaneous deductions (wage garnishment, union dues, charitable donations, etc.).

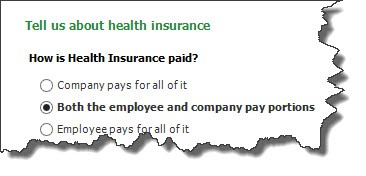

Figure 2: The Payroll Setup Tool helps you make the right choices.

Figure 2: The Payroll Setup Tool helps you make the right choices.

-

-

Prepare and easily submit payroll taxes and tax reporting through QuickBooks Payroll.

-

Fulfilling this ongoing obligation manually can be a big chore! Manually preparing accurate reports and submitting the correct amounts to the correct agencies includes a variety of risks.

Consider the potential for incorrect calculations, missed deadlines, and penalties from various taxing agencies for recurring responsibilities that include FUTA and SUTA, Medicare tax, and FICA, as well as state and local taxes, where applicable.

…

Intuit offers two levels of payroll tax support that work with desktop QuickBooks. You can choose from a variety of services up to and including having federal and state forms automatically completed for you and your taxes electronically filed and paid.

When you choose this option, you can say “Goodbye to payroll reporting and payments risk!“ because your QuickBooks Payroll service takes full responsibility to see that these obligations are properly taken care of. No more worry about timely filings and late payment penalties!

…

-

-

Process payroll quickly and accurately with QuickBooks Payroll.

-

The time you invest in setting up the foundation of your payroll system pays off every time you run payroll. QuickBooks reminds you when it’s time to pay employees and provides you with a clear, simple series of screens for running payroll. If you don’t job cost, you’ll only need to enter the number of hours worked. If you want to track job costs and tasks, you can do that as well.

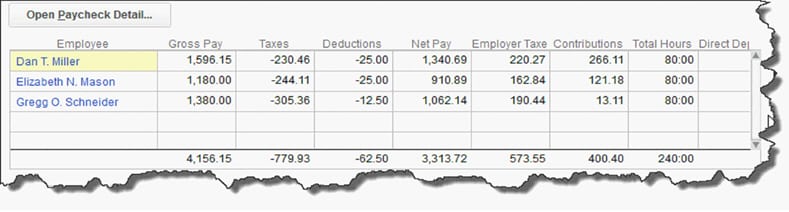

Figure 3: Because you laid a solid foundation during the setup process,

Figure 3: Because you laid a solid foundation during the setup process,

all of the calculations are done for you by QuickBooks.

Want Help Getting Started With QuickBooks Payroll?

There really are no downsides to using one of QuickBooks’ payroll options. Granted, entering and finalizing payroll information requires attention to detail; it’s imperative that you get it right, or you’ll have unhappy employees, hear from taxing agencies and plan providers, and likely encounter various penalties that you’ll need to pay. QuickBooks definitely provides the tools you need…

That said, you may still encounter some complexities when it’s time to set up your underlying structure. Because of this, many of our clients like to recruit some additional experienced assistance. So, if you’re thinking about automating your payroll process, be sure to check out this class: Overview & Concepts: Time Tracking & Payroll (1630/Level 1). If you need someone to guide you through the setup process, give us a call at 734-544-7620 (9-5 Eastern, Mon-Fri). We’ll be pleased to help you “get it right” from the start, and you’ll be able to enjoy payday instead of dreading it!

![]()

People Also Ask

FAQs (Frequently Asked Questions)

1. What are the key benefits of using QuickBooks Payroll?

QuickBooks Payroll simplifies payroll preparation, automates tax calculations and payments, tracks employee benefits, and ensures accurate job costing reporting.

2. How does QuickBooks Payroll help with job costing?

It allows you to assign payroll, payroll taxes, and labor burden costs to specific jobs and tasks, providing detailed job costing reports.

3. Can QuickBooks Payroll handle direct deposits?

Yes, QuickBooks Payroll enables direct deposits to employee accounts, streamlining the payment process.

4. How does QuickBooks Payroll organize employee information?

It stores comprehensive employee details, making it easy to access necessary information for payroll runs and compliance.

5. What types of benefits can QuickBooks Payroll track?

QuickBooks Payroll tracks various benefits such as health, dental, life insurance, retirement contributions, paid time off, and more.

6. How does QuickBooks Payroll simplify tax reporting?

It prepares and submits payroll taxes and reports accurately, reducing the risk of errors and penalties.

7. Is QuickBooks Payroll suitable for small and mid-sized businesses?

Yes, it is designed to meet the needs of small and mid-sized businesses by simplifying payroll processes and ensuring tax and reporting compliance.

8. What support options are available with QuickBooks Payroll?

Intuit offers different levels of payroll tax support, including ‘done-by-you’ and ‘done-for-you’ (automatic) form completion and electronic filing.

9. How does QuickBooks Payroll improve payroll accuracy?

Automating calculations and reminders reduces the chances of errors and ensures timely payroll processing.

10 Where can I find more information on setting up QuickBooks Payroll?

Additional resources and guides are available on the Build Your Numbers website.

![]()

Learn more about our Construction Accounting and Manufacturing Program (CAMP) classes and discover our variety of additional job costing support products!

What our customers say about Diane Gilson and Info Plus Accounting

⭐⭐⭐⭐⭐ From the Intuit FindAProAdvisor website:

“It has been a great experience working with Diane, I was a Peachtree user for over 15 years and she made the transition over to QuickBooks very easy. In working with Diane, I actually enjoy QuickBooks now, and if I get in a situation that I don’t understand something I can call her office or send her an email and she is ready to respond. Diane is highly recommended!”

See More Customer and Client Comments