Paul (of Paul’s Perfect Projects, LLC) tackles the gross profit problem by showing Dave his Estimate vs. Actual variance reports. (If you haven’t already read it, you’ll want to visit Part 1 of this “Tale of 4 Companies: A Job Cost & Gross Profit Drama” before jumping into the following “Part II”…)

Paul’s Approach to Taming their Gross Profit Problem

When Dave arrived at Paul’s office, it was nearly lunchtime, but Paul handed over a cup of coffee and a legal pad – “For notes,” he said. “Let’s see what we can get through in the next few minutes. Then we’ll take a break for lunch and pick up again afterward.”

They settled in at a conference table, and Paul got straight to the point. “Just like you, we put a job cost reporting system into place that showed us total costs for labor, materials, subcontractors, and other job costs, by account, for each job.

Those reports gave us some good information – better than anything we’d had in the past.”

“But, the more we reviewed those results, the more we realized we wanted more. We needed information that would show us enough details to let us manage and control our results and understand our gross profit.”

“Big-picture overviews have their place, but when it comes to tracking and monitoring job costs, our management team agreed that our reports needed more depth.”

“We brainstormed and decided that we wanted to see information that would help us answer questions like,” Paul held up four fingers and ticked off:

-

- “If we had too much cost showing up in labor, exactly WHERE did those labor over-runs occur?”

- “Where we were over budget on material costs, which materials costs were different than we’d estimated?”

- “When subcontractor costs were lower than anticipated, had we really saved money? Or did it just mean that some of our trade contractors hadn’t submitted their bills to us yet?”

- “If we had errors in our estimated costs, exactly what were our problem areas? Were we…

- Failing to include some costs altogether?”

- Underestimating the quantities required?”

- Using the wrong unit costs?”

We couldn’t see our Gross Profit until after…

“Our existing reports weren’t telling us any of those things! AND we couldn’t see our gross profit and the actual financial picture until AFTER we completed the job – which was too late!

So we decided that we needed to control the financial results by monitoring and controlling the project throughout its life. We needed to dig further into the details – from beginning to end.”

Dave nodded in agreement, “Yup, I know what you mean. Exactly the kinds of questions I’ve been asking! Oh, and by the way – you mentioned ‘job budgets.’ So how were you coming up with estimated income and costs for jobs?”

“Well,” Paul responded, “we experimented with various systems over the years. And eventually, we developed a fairly complex set of internal spreadsheets. So that’s typically how we created our detailed cost estimates.”

“The problem was that the spreadsheets weren’t integrated with our accounting system. So we ended up with detail in spreadsheets, while our summary information showed up in our accounting reports.”

Looking for a prebuilt Chart of Accounts, Cost Codes, and Job Cost Reports

for your QuickBooks desktop software?

Click here or on the image above to check out AccountingPRO™

“Every once in a while, we’d put together additional spreadsheet reports to compare the two.

But it was a huge amount of extra work, so it didn’t happen on a regular basis. And the results never seemed to line up with our accounting records, so we never believed the gross profit numbers.”

“What we really needed was to be able to see estimated vs. actual costs as each job progressed to determine gross profit. And we didn’t want to have to jump through hoops to do it!”

Weekly estimated vs. actual details help maximize gross profit results

“From a management standpoint, we weren’t worried about what was happening with every nut and bolt – but we agreed that we DID need to see weekly estimated vs. actual reports for each job. And we wanted to see the results:

- …Split out by job stage or phase,”

- …Organized in about the same order as the job stages,”

- …AND to see those phases, divided into labor costs, materials, contracted costs, and other job costs.”

“We also wanted to see exactly what had been invoiced to the project at any given point.”

“So, after you got those requirements nailed down, what happened then?” asked Dave.

Paul responded, “Well, we figured there must be SOME way to do this with QuickBooks – we just didn’t know how to go about it. Fortunately, we found a QuickBooks ProAdvisor who was a job cost expert, and she had us prepare an outline of our normal job processes.”

“Then she helped us set up our internal procedures and reports so that we could run a standard QuickBooks report that showed us exactly what we needed to see for each individual job and would help us understand our gross profit. It took some setup time, but we got there!”

“Since I invited you here to take a look at what we’re currently using, I pulled the first and last page of one of our early ‘in-process’ reports.

I drew in some arrows and numbers and highlights so we can walk through it together. You can make some extra notes on that legal pad I handed you.”

Looking to set up your own Estimate vs. Actuals Reports?

Check out our Construction Accounting and Manufacturing Program (CAMP) classes!

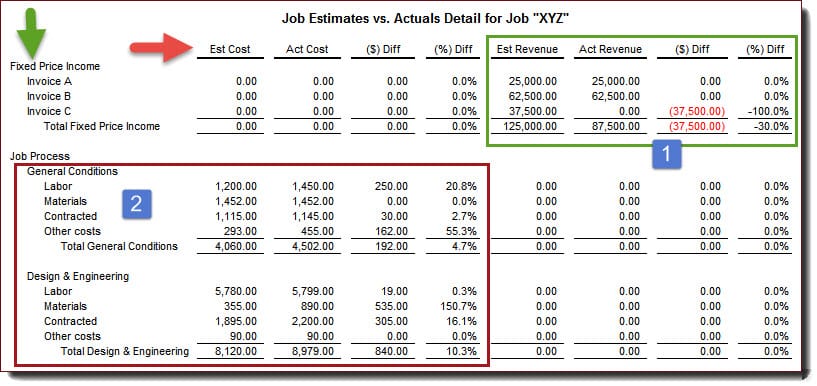

Example: QuickBooks Estimates vs. Actuals Report

“This is the basic format of what our new reports look like. For now, let’s just focus on the top section of the report: If you look at the red arrow and the column titles, you’ll see that we have columns to show estimated vs. actual results for both cost and income.”

Dave noted the red arrow and reviewed the column titles.

Paul continued, “We’ve started using the Items feature in QuickBooks to enter estimated income and costs as well as actual income and costs. That way our ‘actual’ results always line up with our accounting records.”

“So, if you look on the left side of the report – under the green arrow, you’ll see specific line items.”

“We’re still using our spreadsheets to create the detailed estimates, but we’re summarizing and entering the results into QuickBooks in the format that we’d like to see for our reports.”

“We’ve also been thinking about how we can stop using those old spreadsheets and just start using QuickBooks for our estimating process and to determine gross profit. We’re pretty sure that can work for us, but one step at a time, right?”

Dave agreed. “Yup, if I learned one thing about the changes that we made last year, it’s that putting a job cost system into place isn’t a one-time event. It’s definitely a process!”

Paul smiled. “Yes indeed! So, back to this particular report… If you take a look at the top, right-hand side – see the blue number 1? In the green box? You’ll notice that this report shows one of our fixed-price jobs. You can see that we’ve included our three anticipated billings to the client in this top section.”

Reporting Gross Profit for Fixed Price and Time & Materials

Dave couldn’t help himself – he had to jump in at this point with an immediate concern. “OK, I’m seeing that. And wow, yes, this is exactly the kind of information that I’ve been looking for.”

“But not all of my jobs are fixed-price jobs – and sometimes I have Change Orders. I don’t want to be confined to a fixed-price basis because that’s what my accounting system requires!”

Paul nodded. “Yes, I totally understand. And no, you are NOT constrained to just one pricing method. So, for example, for ‘time and materials’ or ‘cost plus’ jobs, we just use the cost line items for invoicing, and then the estimated and actual revenue can show up on those lines rather than at the top, where you see them now.”

“And we have to track Change Order costs and invoicing in our company as well to determine gross profit. So, although you don’t see them included in this report – this is an ‘early on’ report for this job – we make sure that nothing gets missed from a cost and invoicing standpoint when it comes to change orders.”

We can either show Change Orders waiting to be invoiced in this top section of the report OR,” he pointed at the lower rows in the report, “we can estimate and invoice for those extras based on the more detailed line items shown further down. It just depends on how our contract is structured.”

“Ah, OK. I see.” Dave sounded both hopeful and relieved. “So I could use this approach regardless of what invoicing arrangements – or type of job – we take on, right?”

“Right!” Paul agreed.

Paul Explains Quickbooks Items for Labor, Materials, Contracted, and Other Costs

“So, let’s take a look at the sections I blocked off with the number 2 in the red box. You’ll see that we have headers for these first couple of job stages.”

“You’ll notice that each header includes line items for Labor, Materials, Contracted, and Other Costs. There are also certain job stages – that you don’t see here – where we also added line items for ‘Machinery & Equipment’ costs. By using Items, you have total control over how you make entries and what your reports look like.”

Dave was puzzled. “You’ve mentioned using ‘Items’ several times now. I’ve just been using accounts. I’m not familiar with Items. It sounds like another feature in QuickBooks that I need to set up. If I do that, does it mean that I have to enter my information twice – once in my accounts, and another time in Items?”

Paul laughed. “Well, I probably wouldn’t be alive if I doubled my accounting staff’s workload!”

No “double-entry” when using Items…

“When you use Items, no double entry is required. Here’s how it works: you set up each Item to link to your income and cost accounts.

Then, when you enter an Item into a transaction and assign it to a job, it ALSO automatically posts to an account.”

“QuickBooks handles everything in the background. That way you can ‘slice and dice’ your information based on how YOU want to see it. So that means you can either:

- Run ‘account-based’ reports, by job, in the traditional format, where you can see your costs summarized in the traditional account-style format. You can still see your gross profit totals by job – just like you told me that you’re currently doing, OR

- You can create ‘Item-based’ reports – like the one I’m showing you now.”

Paul checked his watch. “Say, I see that it’s 11:30, and I made lunch reservations, so let’s take a short break for food, and you can absorb what we’ve covered so far while we’re eating. Then, we’ll jump back into the rest of the report when we get back.

“I’ll share more about how we use the results and what that means for our gross profit.”

“I’ll also pull in a few of the people who are using the reports on a regular basis – so you can hear what they have to say.”

Dave grinned. “Hey, sounds good to me – I never turn down lunch when it’s offered. And I do want to thank you for bringing me in. This is great stuff, and I’m really enthused about seeing that we can do so much more with the QuickBooks software that I already own!”

Your Next Installment:

Part III – How Bookkeeping Supports Job Cost & Gross Profit Measurement – Paul asks his bookkeeper (Rhonda) to share her thoughts about their new process. Read Part III…

Looking for a prebuilt Chart of Accounts, Cost Codes, and Job Cost Reports

for your QuickBooks desktop software?

Click here or on the image above to check out AccountingPRO™

Customer Praise For Diane Gilson, Info Plus Accounting, and BuildYourNumbers.com

⭐⭐⭐⭐⭐ From the Intuit FindAProAdvisor website:

“Diane took the time to understand the problems I was having and using her overhead allocation spreadsheet, we accurately allocated overhead in our company. Diane was very easy to work with and makes numbers easy to understand. I recommend her work.”

See More Customer and Client Comments