How Bookkeeping Supports Job-Cost & Gross Profit Measurement at Paul’s Perfect Projects, LLC

If you haven’t already read them, you’ll probably want to visit Part I and Part II of this “Tale of 4 Companies: A Job-Cost & Gross Profit Drama” before starting the following “Part III.” In Part III, Paul & Dave have just returned from lunch and are continuing their meeting…

When Dave and Paul returned from lunch, Paul checked the new notes waiting for him on his desk. “A slight change in scheduling,” he announced. “It turns out that our bookkeeper, Rhonda, has an appointment and needs to leave by 1:30, so I’ll ask her to stop in to talk to us before she leaves for her appointment.”

When Dave and Paul returned from lunch, Paul checked the new notes waiting for him on his desk. “A slight change in scheduling,” he announced. “It turns out that our bookkeeper, Rhonda, has an appointment and needs to leave by 1:30, so I’ll ask her to stop in to talk to us before she leaves for her appointment.”

Paul glanced at his watch and said he’d be right back. Dave pulled out his notes and looked again at the report they had started to review before lunch.

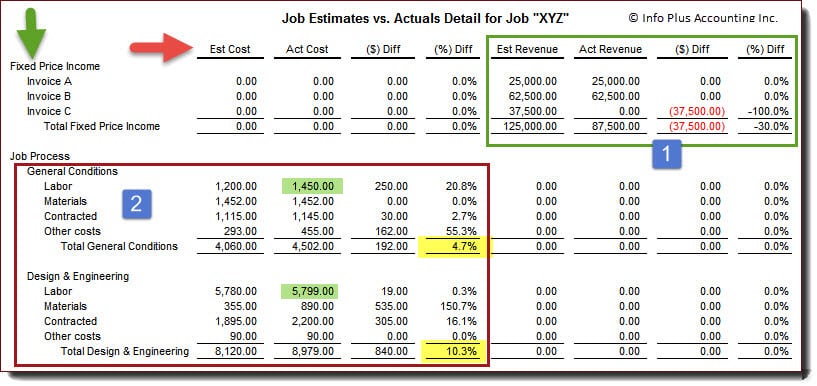

A Second Look at the Estimates vs. Actuals Report…

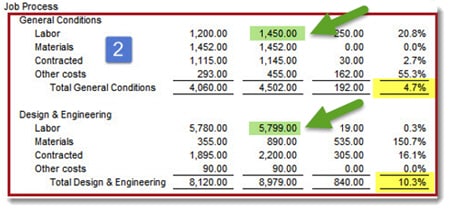

He focused on the section surrounded by the red box and blue number 2. When he compared Estimated Cost to Actual Cost, he noticed that all but two line items within the General Conditions and Design & Engineering stages showed unfavorable dollar and percentage differences. He highlighted the subtotals in yellow and thought to himself, “Hmmmm. I wonder what they did when they saw these numbers?”

He also questioned exactly what was included in the Labor “Actual Cost” amounts, and his gross profit, so he grabbed another highlighter off the table and marked those numbers in green.

At that point, Paul walked in with Rhonda. After introducing Rhonda as “Our numbers person – someone we couldn’t live without!” he quickly filled Rhonda in on Dave’s dilemma and what he’d shared so far.

“I asked you to this meeting because I’m hoping you’ll be willing to share some of your insights on gross profit – from the bookkeeping and accounting perspective – with Dave. Of course, he’ll probably have a few questions of his own to throw into the mix. So please, just be open and let him know some of your thoughts about the process….”

Making Changes to Rhonda’s (Prior) QuickBooks Accounting System

Rhonda turned to Dave and said, “Hi – nice to meet you! So, when Paul initially talked with me about bringing someone in to help revise our QuickBooks accounting system, I really wasn’t totally on board with that idea.”

Rhonda turned to Dave and said, “Hi – nice to meet you! So, when Paul initially talked with me about bringing someone in to help revise our QuickBooks accounting system, I really wasn’t totally on board with that idea.”

“I was pretty much self-taught in bookkeeping and QuickBooks. However, our outside tax accountant showed me how to make entries into QuickBooks right after I first came to work here, and I had been using it that way ever since.”

“I made sure that income and costs were assigned to jobs, our bank accounts were reconciled, and our Accounts Payable, Accounts Receivable, Gross Profit and Net Profit reports were right. Our tax preparers seemed to be just fine with what I was giving them, so my first response was, ‘If it ain’t broke, why try to fix it?’”

Then she smiled. “But of course, I was used to just looking at it from my perspective of ‘Get the data IN and get the bookwork DONE!’ “

What Changed Rhonda’s Mind?

“Then Paul spent a little more time with me and explained that he thought we should be doing much better financially and that he and the job supervisors just weren’t able to see some of the detailed information that they needed to hit our profitability targets and determine gross profit.”

“I gave it some thought and decided I needed to be willing to do whatever was needed to move the entire company ahead. So I jumped on board. In this day and age, I think you have to be flexible and open to new ways of doing things. And I remember thinking, ‘Who knows? Maybe I’ll have some fun learning a few new ways of doing things.’”

Looking for a prebuilt Chart of Accounts, Cost Codes, and Job Cost Reports

for your QuickBooks desktop software?

Click here or on the image above to check out AccountingPRO™

Accounting Changes Help Paul’s Perfect Projects, LLC Meet Job-Cost and Gross Profit Goals

Dave nodded, “Sounds like you’ve got a great team player here, Paul!” Paul nodded in agreement, “Yup, we do.”

Rhonda continued. “So the first big transition for me was learning how Items in QuickBooks worked and how they link to cost and income accounts.”

Rhonda continued. “So the first big transition for me was learning how Items in QuickBooks worked and how they link to cost and income accounts.”

“We did have to make a mental shift. It took a little while to remember that we needed to enter job costs and income using Items rather than accounts. But once we got that part under control, there really wasn’t any extra work involved.”

“Of course, since Items track detailed costs, there were more of them to choose from, so we organized and grouped them into a logical flow. Then we set up some ‘cheat sheets’ we could use to make it easy to enter those Items.”

She added, “QuickBooks also has a feature that can automatically recall the last account or item you used with a transaction and vendor so that calculating gross profit is easy. So, by the time we entered a couple of months of data, our day-to-day entries started to work very smoothly.”

Tracking Time by Task Helps Meet Job-Cost and Gross Profit Goals

“We’d already worked out our labor burden percentages and included them in our job cost reports. But, we weren’t tracking labor by the type of task being performed. We learned that type of tracking would require us to use QuickBooks Service Items, so we created and distributed an abbreviated list of “Cost Codes” (Service Items) to our employees.”

Dave was curious. “So how did your employees and staff feel about that change?”  Rhonda lifted her eyebrows and looked to Paul to answer the question.

Rhonda lifted her eyebrows and looked to Paul to answer the question.

He picked up the ball. “Well, they weren’t overjoyed about it, but we had several meetings, discussed the reasons for the changes, and asked for their support and cooperation. We also gave them a few weeks to get used to the idea before implementing it. Then we set up coaching and feedback meetings to help the few people who were having a hard time making the transition.”

“In a couple of cases, we had to refer to our policy of ‘This is how we do things here, and if it doesn’t match up with your philosophy, then we may not have a good fit.’ So one or two people decided to move on, but time-tracking wasn’t their only issue, so it was probably for the best.”

Support From the Top is Critical

Rhonda added, “It was really important for us to have that kind of support come from the top of the company. I could tell anyone who gave me a hard time about their timesheet entries that they should speak with their supervisor. I haven’t gotten any direct grumbling for quite some time now! So I think the time collection system is working pretty well at this point.”

“With that piece in place, our supervisors review time and job assignments for accuracy and can make changes before the payroll is processed. So, after supervisory approval, payroll gets assigned to job costs based on time and cost codes. The whole system is now integrated, and it helps meet our gross profit goals.”

“I’ve been looking at this report,” said Dave, “and I highlighted the line items for actual labor costs in green – right here in this red box. Exactly what’s included in that number?”

Rhonda leaned in to take a quick look. “You’ve highlighted the actual labor cost. It includes the employee’s hourly pay – both regular and overtime. It also includes all of the employer’s payroll taxes AND the labor burden costs we’ve determined should be assigned for each employee. So the amounts you’re seeing on this report for labor costs are all-inclusive.” “Ah, now I understand,” said Dave. “Pretty impressive.”

Rhonda leaned in to take a quick look. “You’ve highlighted the actual labor cost. It includes the employee’s hourly pay – both regular and overtime. It also includes all of the employer’s payroll taxes AND the labor burden costs we’ve determined should be assigned for each employee. So the amounts you’re seeing on this report for labor costs are all-inclusive.” “Ah, now I understand,” said Dave. “Pretty impressive.”

How Does This Comprehensive Job-Costing System Impact Accounting Workloads?

Dave continued. “One more question. So compared to before – is there more work, or less work, from an accounting perspective?”

Rhonda laughed, “Well, after we made the changes – which required a big push and a stretch of late nights and weekends, it’s probably about the same.

Rhonda laughed, “Well, after we made the changes – which required a big push and a stretch of late nights and weekends, it’s probably about the same.

“In some ways, it feels like there’s more data entry on the front end of a job. For instance, we’re using detailed Estimates and Purchase Orders in QuickBooks. But, as we do our monthly work, we convert estimates into invoices and purchase orders into bills – without having to track down project managers to find out what jobs or Items to use. So that saves a lot of time and frustration in determining gross profit.”

“It’s also much faster and easier to provide the reports that management wants to see. “We don’t have to create a boatload of time-consuming spreadsheets and hand-prepared reports.”

“Our ProAdvisor also shared a lot of other time-saving features we didn’t even know about. For example, we learned about keystroke shortcuts, embedded document storage, memorized transactions, and memorized reports. Those features are handy, they help reduce “busy work,” and save admin time which contributes to our net profit goals.”

Checking the Accuracy of Company and Gross Profit Reports

“We’re also using the Month-End Closing Procedure for QuickBooks, so we can ensure that we have a clean set of books each month. That way, our year-end is pretty much like a standard month-end closing, so we’re done with the bulk of the year-end work by mid-January.”

She glanced at her watch. “Oops. I’m really sorry we had to make this so brief, but I’ve got to run if I’m going to make it to my appointment on time. If you have any other questions, please feel free to get in touch. Paul has my contact info.”

As she prepared to leave, Dave stood up to shake her hand. “I think you did a great job of giving me a birds-eye view about what changes from the financial and bookkeeping perspective. I also appreciate hearing how you and Paul handled asking employees to track the tasks that they’re working on.

“It appears that you’ve been a key player in improving your job-costing system. That system really contributes to being able to determine, and report on, your gross profit.”

“It also seems that you’ve been hugely impactful in creating a great team environment here at Paul’s Perfect Projects. Thank you so much for sharing! “

Next Blog Posting:

Part IV – How Estimators and Supervisors Focus on Job-Costs & Meeting Gross Profit Goals at Paul’s Perfect Projects, LLC. Project managers and Estimators discuss how they create and review Estimates, and then use the Estimate vs. Actual reports as projects get underway. Read Part IV…

Learn more about our construction accounting and manufacturing program classes and discover our job-cost support products!

Customer Praise For Diane Gilson, Info Plus Accounting, and BuildYourNumbers.com

⭐⭐⭐⭐⭐ From the Intuit FindAProAdvisor website:

“Wonderful company to work with. Amazing helpful and courteous staff. Diane is a wealth of QuickBooks knowledge, she is a great teacher that is specific to your needs. The webinars are great, the personal help is what sold me. Highly recommend.”

See More Customer and Client Comments