How Much Are You Losing From Undercharging for Employee Time?

This Free Calculator Helps You Estimate!

Underbilling for Employee Labor? Here’s what that’s costing you!

Free Labor Calculator

Here’s a free calculator to help you do the math. If you are underbilling for employee labor, use it to discover how much revenue you may lose over 1, 3, and 5 years.

Just enter four numbers in the yellow cells below to show your results.

(I’ve also added examples and other notes below the calculator.)

How to use this free calculator:

- Enter Your Estimates in the Yellow Cells ONLY. Start with Annual production Hours per Worker. (Entering data in other cells will invalidate the results).

- To start over, refresh the page. . .

- If you’re not sure how much you may be undercharging per hour, or you’re not clear about your annual production hours, the examples shown below the calculator may be helpful…

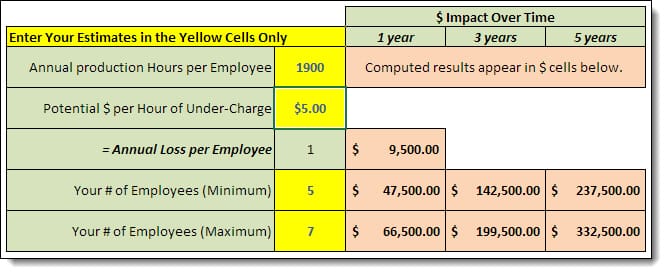

Example: Underbilling Calculator Example #1:

Every company’s estimates will vary, but here’s a screenshot of what the calculator would show if we entered estimates of:

- 1,900 hours per year of average “production” time. (2,040 available work hours + overtime, (-) all paid time off, and other ‘non-production’ time such as company meetings, timesheet prep, non-job breaks, and other ‘non-job’ time.)

- Estimated average underbilling of $5 per production hour.

- From 5 to 7 revenue-earning (‘production’) employees.

…Results Show a 5-Year Revenue Loss of $237,500 to $332,500!

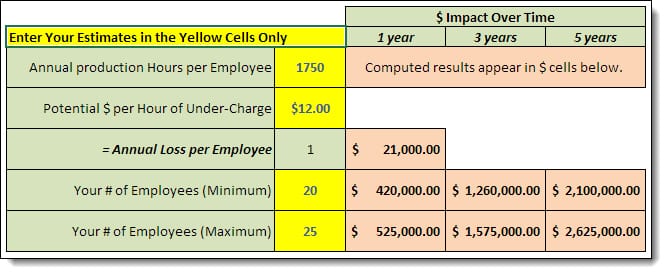

Example: Underbilling Calculator Example #2:

Changing the variables has a different impact on lost revenue. For this example, we’ve entered estimates of:

- 1,750 hours per year of “production” time - including overtime. (Many service workers have less time assignable to jobs, so we show fewer annual project hours.)

- Estimated underbilling of $12 per production hour.

- From 20 to 25 revenue-earning (‘production’) employees.

= 5-Year Revenue Loss of $2.1 to $2.6 Million!

Of course, the numbers get proportionally larger for larger companies with more employees!

What the Labor Underbilling Calculator Reveals...

-

- You may start out with what looks like a fairly small hourly underbilling difference. But, when multiplied by a number of employees over several years, it can amount to a staggering loss of revenue!

- This revenue reduction flows directly to your bottom line (or more importantly, every cent you underbill does NOT flow to your bottom line!)

- You can imagine that these reductions can ultimately determine a company’s long-term success or failure.

Could YOU Be Underbilling?

If there is a possibility that you might be underbilling, please take a few moments to enter some estimates into the free calculator at the beginning of the article to see the potential impact on YOUR company’s revenue (and bottom line).

If you’re in doubt about “Annual production hours per employee” or “Potential $ per hour of undercharge” (the first two cells in the underbilling calculation), please be sure to consider the following...

Do you know:

- Your annual production hours per employee?

- What each employee really COSTS per production hour?

- How much per hour you SHOULD charge (or build into your project costs) to hit your gross profit goal for employee labor?

- Based on those results, how much per hour are you currently underbilling?

Now that you see the huge effect labor under billings can have on your revenue, click on any of the above links to look at a unique resource we’ve developed to help you determine exactly what those underlying numbers look like for YOUR company. You’ll find these videos and information to be both informative and eye-opening...

![]()

People Also Ask

FAQs (Frequently Asked Questions)

1. What is underbilling in accounting?

Underbilling refers to the situation where the amount billed to a client or customer for services rendered is less than the actual costs incurred for providing those services.

2. How is underbilling calculated in project accounting?

Underbilling is calculated by subtracting the total amount billed from the total costs incurred on a project. The result indicates the amount that has not yet been billed to the client.

3. What are the causes of underbilling in construction projects?

Causes of underbilling include inaccurate cost estimation, change orders, scope creep, delays in project completion, and billing errors.

4. Why is it important to monitor underbilling in projects?

Monitoring underbilling helps project managers maintain cash flow, accurately forecast revenue, and identify potential issues early to prevent financial losses.

5. How can QuickBooks help in tracking underbilling and employee labor costs?

QuickBooks allows businesses to track project expenses, labor costs, and billable hours, making it easier to monitor underbilling and ensure accurate invoicing.

6. What strategies can be used to minimize underbilling in project management?

Strategies include conducting thorough cost estimates, implementing effective project controls, communicating clearly with clients, and regularly reviewing project budgets and progress.

7. What are the consequences of persistent underbilling in construction or service projects?

Consequences include reduced profitability, strained cash flow, disputes with clients, delayed payments to vendors, and potential damage to the business's reputation.

8. How does employee labor factor into underbilling calculations?

Employee labor costs contribute to underbilling calculations as they represent a significant portion of project expenses that need to be accurately accounted for in billing.

9. What role does accurate time tracking play in preventing underbilling?

Accurate time tracking ensures that all billable hours are accounted for, reducing the risk of underbilling and helping businesses optimize resource allocation and project profitability.

10. Where can I find more resources and guides on underbilling calculation and employee labor management?

Additional resources and guides are available on the Build Your Numbers website.

![]()

Customer Praise For Diane Gilson, Info Plus Accounting, and BuildYourNumbers.com

⭐⭐⭐⭐⭐ From the Intuit FindAProAdvisor website:

“We have worked with Diane since 2007 when we installed QuickBooks as our accounting system. She has walked us through set-up, taught us how to use QB, and does monthly follow up to make sure everything is going as it should. We are a manufacturing company with inventory, and we also do our own payroll. We have given Diane numerous problems to solve, and she has figured them out in no time. She is very personable, reliable, and easy to work with, and I look forward to working with her every month.”

See More Customer and Client Comments