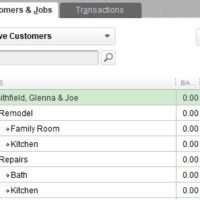

Improving your QuickBooks accounting system to get job costing, and more useful management reports can be very similar to pulling off a family pumpkin-carving experience. You need planning and preparation, the right tools, and possibly a support system to help get the job done.