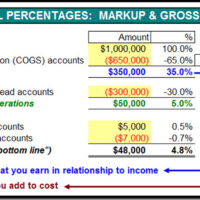

Manufacturing Overhead Costs To calculate Manufacturing Overhead by Job, be sure to include both manufacturing direct labor costs and manufacturing overhead labor costs. How To Calculate Labor Cost One key in calculating the labor cost portion of your manufacturing overhead is understanding the difference between manufacturing direct labor costs and manufacturing overhead labor. Which of …